Question: HOMEWORK ASSIGNMENT 3 Instructions: Show step-by-step calculations. The homework is due at 8 am on March 21. Late submission will not be accepted. 1. You

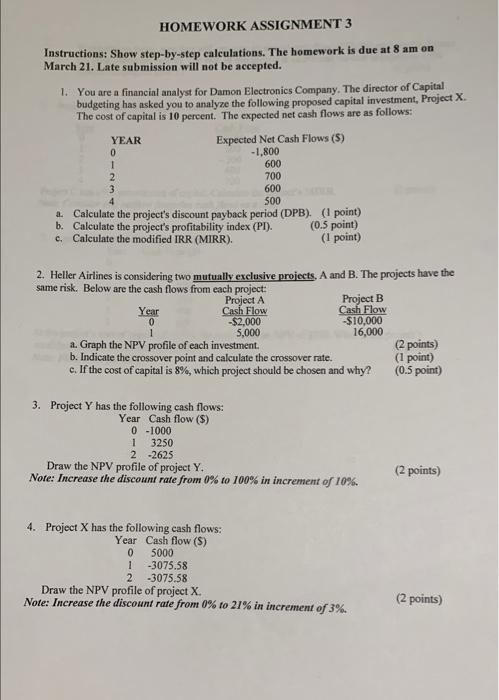

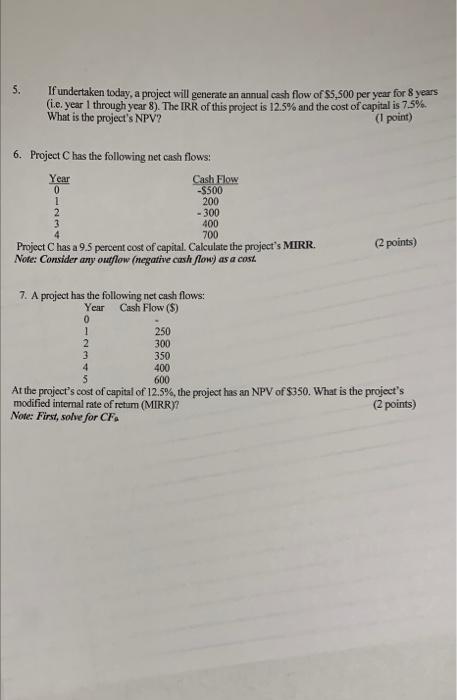

HOMEWORK ASSIGNMENT 3 Instructions: Show step-by-step calculations. The homework is due at 8 am on March 21. Late submission will not be accepted. 1. You are a financial analyst for Damon Electronics Company. The director of Capital budgeting has asked you to analyze the following proposed capital investment, Project X. The cost of capital is 10 percent. The expected net cash flows are as follows: YEAR Expected Net Cash Flows (5) 0 -1,800 1 600 2 700 3 600 500 1. Calculate the project's discount payback period (DPB) (1 point) b. Calculate the project's profitability index (PI). (0.5 point) c. Calculate the modified IRR (MIRR). (1 point) 2. Heller Airlines is considering two mutually exclusive projects, A and B. The projects have the same risk. Below are the cash flows from each project: Project A Project B Year Cash Flow Cash Flow 0 -$2,000 $10,000 1 5,000 16,000 a. Graph the NPV profile of each investment. (2 points) b. Indicate the crossover point and calculate the crossover rate. (1 point) c. If the cost of capital is 8%, which project should be chosen and why? (0.5 point) 3. Project Y has the following cash flows: Year Cash flow (5) 0-1000 3250 2 -2625 Draw the NPV profile of project Y. Note: Increase the discount rate from 0% to 100% in increment of 10%. 1 (2 points) 4. Project X has the following cash flows: Year Cash flow (5) 0 5000 1-3075.58 2 -3075.58 Draw the NPV profile of project X. Note: Increase the discount rate from 0% to 21% in increment of 3%. (2 points) 5. If undertaken today, a project will generate an annual cash flow of $5,500 per year for 8 years (ie. year I through year 8). The IRR of this project is 12.5% and the cost of capital is 75%. What is the project's NPV? (1 point) 6. Project C has the following net cash flows: Year Cash Flow 0 -$500 1 200 2 - 300 3 400 700 Project C has a 9.5 percent cost of capital Calculate the project's MIRR. Note: Consider any outflow (negative cash flow) as a cost (2 points) 7. A project has the following net cash flows: Year Cash Flow ($) 0 1 2 250 300 350 400 600 At the project's cost of capital of 12.5%, the project has an NPV of $350. What is the project's modified internal rate of retum (MIRR)? (2 points) Note: First, solve for CF. HOMEWORK ASSIGNMENT 3 Instructions: Show step-by-step calculations. The homework is due at 8 am on March 21. Late submission will not be accepted. 1. You are a financial analyst for Damon Electronics Company. The director of Capital budgeting has asked you to analyze the following proposed capital investment, Project X. The cost of capital is 10 percent. The expected net cash flows are as follows: YEAR Expected Net Cash Flows (5) 0 -1,800 1 600 2 700 3 600 500 1. Calculate the project's discount payback period (DPB) (1 point) b. Calculate the project's profitability index (PI). (0.5 point) c. Calculate the modified IRR (MIRR). (1 point) 2. Heller Airlines is considering two mutually exclusive projects, A and B. The projects have the same risk. Below are the cash flows from each project: Project A Project B Year Cash Flow Cash Flow 0 -$2,000 $10,000 1 5,000 16,000 a. Graph the NPV profile of each investment. (2 points) b. Indicate the crossover point and calculate the crossover rate. (1 point) c. If the cost of capital is 8%, which project should be chosen and why? (0.5 point) 3. Project Y has the following cash flows: Year Cash flow (5) 0-1000 3250 2 -2625 Draw the NPV profile of project Y. Note: Increase the discount rate from 0% to 100% in increment of 10%. 1 (2 points) 4. Project X has the following cash flows: Year Cash flow (5) 0 5000 1-3075.58 2 -3075.58 Draw the NPV profile of project X. Note: Increase the discount rate from 0% to 21% in increment of 3%. (2 points) 5. If undertaken today, a project will generate an annual cash flow of $5,500 per year for 8 years (ie. year I through year 8). The IRR of this project is 12.5% and the cost of capital is 75%. What is the project's NPV? (1 point) 6. Project C has the following net cash flows: Year Cash Flow 0 -$500 1 200 2 - 300 3 400 700 Project C has a 9.5 percent cost of capital Calculate the project's MIRR. Note: Consider any outflow (negative cash flow) as a cost (2 points) 7. A project has the following net cash flows: Year Cash Flow ($) 0 1 2 250 300 350 400 600 At the project's cost of capital of 12.5%, the project has an NPV of $350. What is the project's modified internal rate of retum (MIRR)? (2 points) Note: First, solve for CF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts