Question: Homework Assignment 5 1. Explain what a call option on an individual stock is and compare the potential gain and loss associated with writing

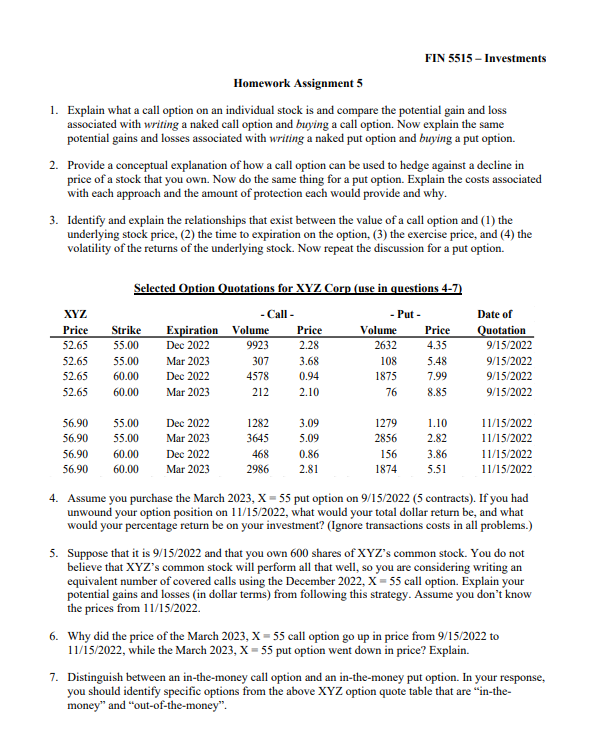

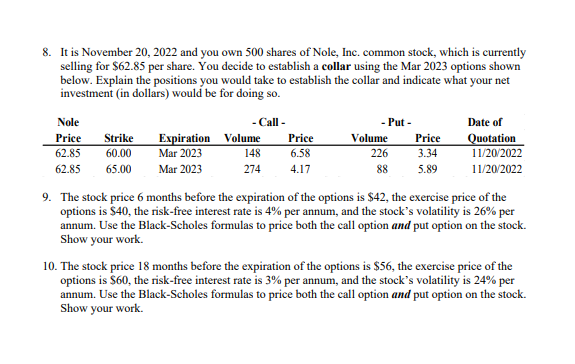

Homework Assignment 5 1. Explain what a call option on an individual stock is and compare the potential gain and loss associated with writing a naked call option and buying a call option. Now explain the same potential gains and losses associated with writing a naked put option and buying a put option. 2. Provide a conceptual explanation of how a call option can be used to hedge against a decline in price of a stock that you own. Now do the same thing for a put option. Explain the costs associated with each approach and the amount of protection each would provide and why. 3. Identify and explain the relationships that exist between the value of a call option and (1) the underlying stock price, (2) the time to expiration on the option, (3) the exercise price, and (4) the volatility of the returns of the underlying stock. Now repeat the discussion for a put option. XYZ Price Strike 52.65 55.00 52.65 52.65 52.65 Selected Option Quotations for XYZ Corp (use in questions 4-7) - Call - -Put- Volume Price 9923 2.28 307 3.68 4578 0.94 212 2.10 56.90 56.90 55.00 60.00 60.00 56.90 55.00 56.90 55.00 60.00 60.00 Expiration Dec 2022 Mar 2023 Dec 2022 Mar 2023 Dec 2022 Mar 2023 Dec 2022 Mar 2023 FIN 5515 - Investments 1282 3645 468 2986 3.09 5.09 0.86 2.81 Volume 2632 108 1875 76 1279 2856 156 1874 Price 4.35 5.48 7.99 8.85 1.10 2.82 3.86 5.51 Date of Quotation 9/15/2022 9/15/2022 9/15/2022 9/15/2022 11/15/2022 11/15/2022 11/15/2022 11/15/2022 4. Assume you purchase the March 2023, X - 55 put option on 9/15/2022 (5 contracts). If you had unwound your option position on 11/15/2022, what would your total dollar return be, and what would your percentage return be on your investment? (Ignore transactions costs in all problems.) 5. Suppose that it is 9/15/2022 and that you own 600 shares of XYZ's common stock. You do not believe that XYZ's common stock will perform all that well, so you are considering writing an equivalent number of covered calls using the December 2022, X - 55 call option. Explain your potential gains and losses (in dollar terms) from following this strategy. Assume you don't know the prices from 11/15/2022. 6. Why did the price of the March 2023, X= 55 call option go up in price from 9/15/2022 to 11/15/2022, while the March 2023, X - 55 put option went down in price? Explain. 7. Distinguish between an in-the-money call option and an in-the-money put option. In your response, you should identify specific options from the above XYZ option quote table that are "in-the- money" and "out-of-the-money". 8. It is November 20, 2022 and you own 500 shares of Nole, Inc. common stock, which is currently selling for $62.85 per share. You decide to establish a collar using the Mar 2023 options shown below. Explain the positions you would take to establish the collar and indicate what your net investment (in dollars) would be for doing so. Nole Price Strike 62.85 60.00 62.85 65.00 Expiration Mar 2023 Mar 2023 - Call - Volume 148 274 Price 6.58 4.17 - Put - Volume 226 88 Price 3.34 5.89 Date of Quotation 11/20/2022 11/20/2022 9. The stock price 6 months before the expiration of the options is $42, the exercise price of the options is $40, the risk-free interest rate is 4% per annum, and the stock's volatility is 26% per annum. Use the Black-Scholes formulas to price both the call option and put option on the stock. Show your work. 10. The stock price 18 months before the expiration of the options is $56, the exercise price of the options is $60, the risk-free interest rate is 3% per annum, and the stock's volatility is 24% per annum. Use the Black-Scholes formulas to price both the call option and put option on the stock. Show your work.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

ANSWER Answer 1 A call option on an individual stock gives the holder the right but not the obligation to buy the underlying stock at a specified price known as the strike price within a specified per... View full answer

Get step-by-step solutions from verified subject matter experts