Question: = Homework: Assignment 5 Question 4, P9-9 (similar to) Part 1 of 3 HW Score: 42%, 42 of 100 points O Points: 0 of 14

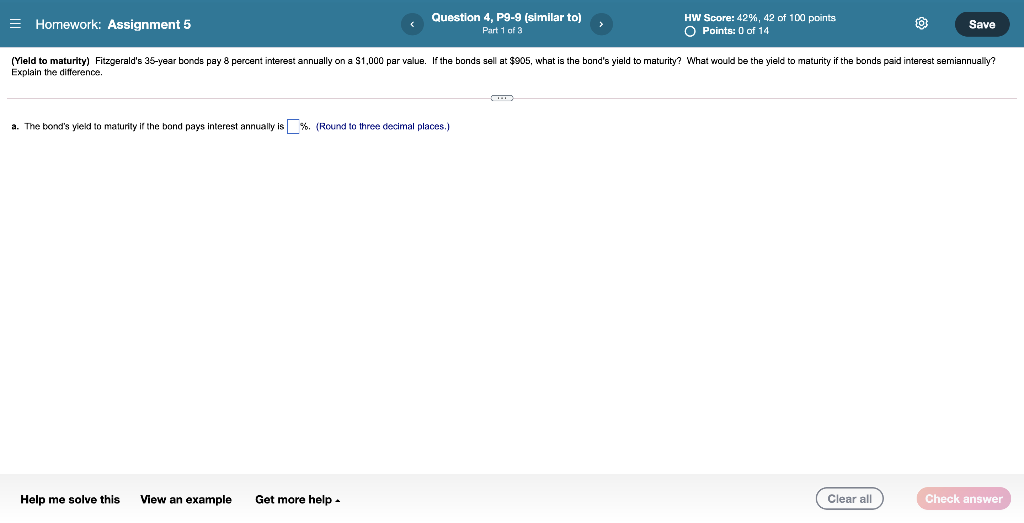

= Homework: Assignment 5 Question 4, P9-9 (similar to) Part 1 of 3 HW Score: 42%, 42 of 100 points O Points: 0 of 14 Save (Yield to maturity) Fitzgerald's 35-year bonds pay 8 percent interest annually on a $1,000 par value. If the bonds sell at $905, what is the bond's yield to maturity? What would be the yield to maturity if the bonds paid interest semiannually? Explain the difference. a. The bond's yield to maturity if the bond pays interest annually is %. (Round to three decimal places.) Help me solve this View an example Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock