Question: = Homework: Assignment 7 Question 3, P8-28 (similar to) Part 1 of 7 HW Score: 0%, 0 of 8 points O Points: 0 of 1

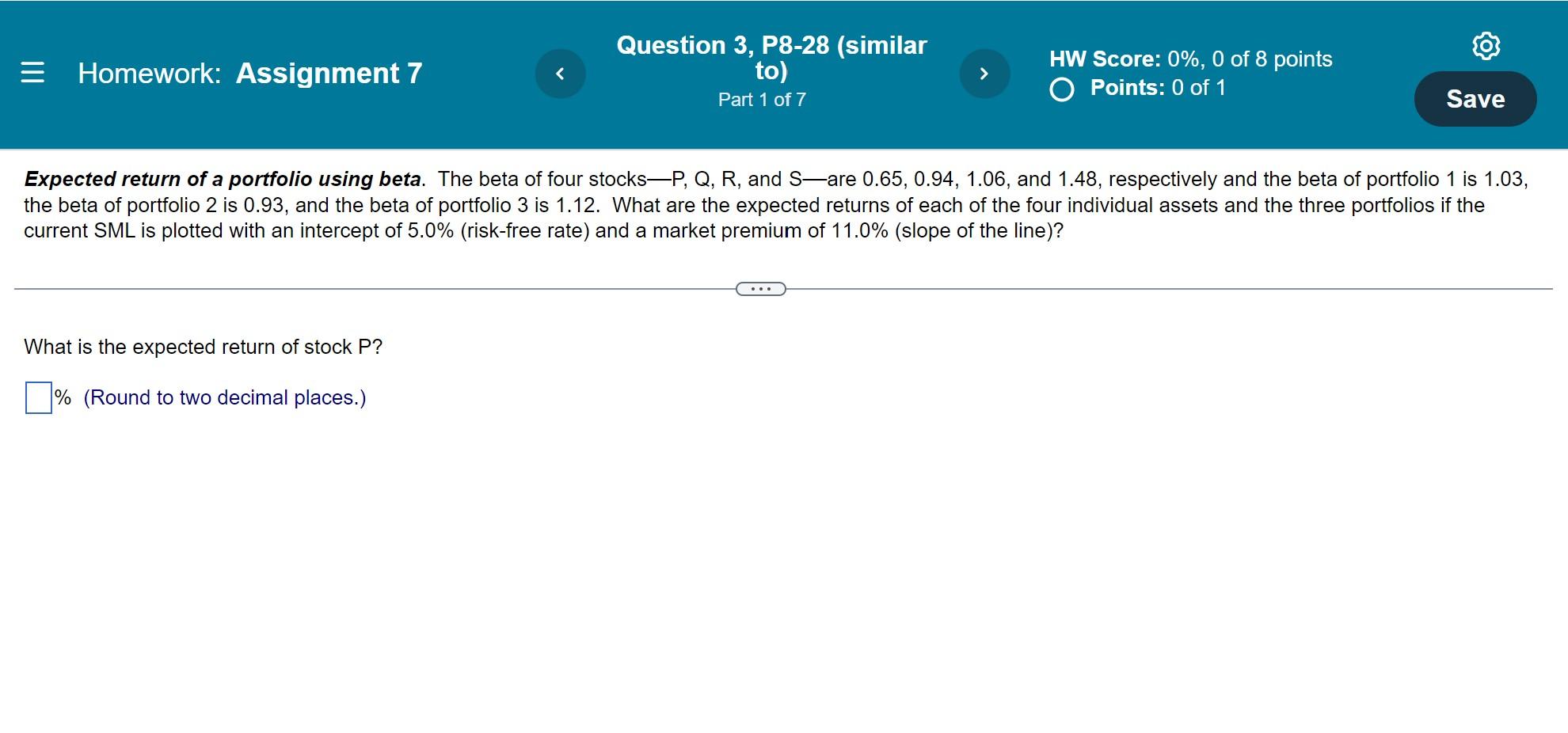

= Homework: Assignment 7 Question 3, P8-28 (similar to) Part 1 of 7 HW Score: 0%, 0 of 8 points O Points: 0 of 1 Save Expected return of a portfolio using beta. The beta of four stocksP, Q, R, and sare 0.65, 0.94, 1.06, and 1.48, respectively and the beta of portfolio 1 is 1.03, the beta of portfolio 2 is 0.93, and the beta of portfolio 3 is 1.12. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 5.0% (risk-free rate) and a market premium of 11.0% (slope of the line)? What is the expected return of stock P? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock