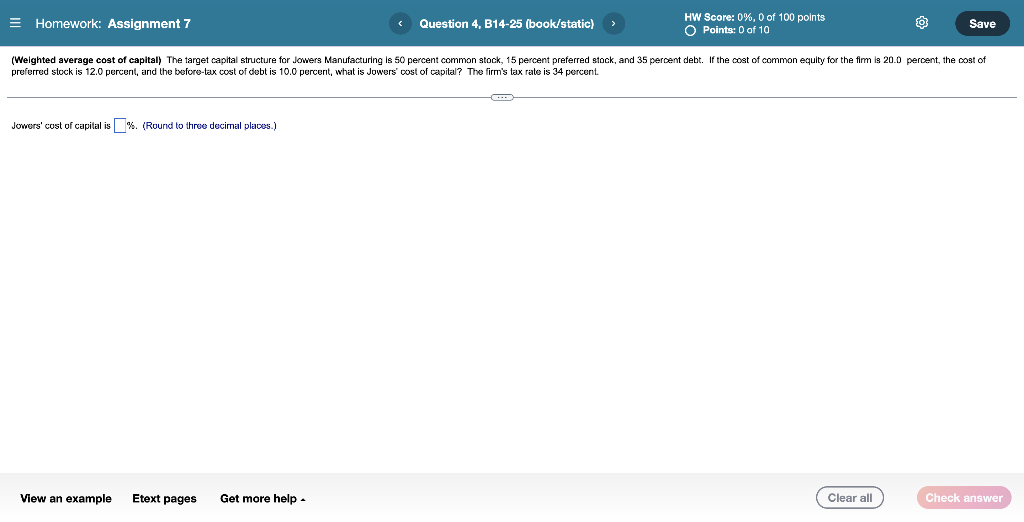

Question: Homework: Assignment 7 Question 4, B14-25 (book/static) HW Score: 0%, 0 of 100 points O Points: 0 of 10 O Save (Weighted average cost of

Homework: Assignment 7 Question 4, B14-25 (book/static) HW Score: 0%, 0 of 100 points O Points: 0 of 10 O Save (Weighted average cost of capital) The target capital structure for Jowers Manufacturing is 50 percent common stock, 15 percent preferred stock, and 35 percent debt. If the cost of common equity for the film is 20.0 percent, the cost of preferred stock is 12.0 percent, and the before-tax cost of debt is 10.0 percent, what is Jowers' cost of capital? The firm's tax rate is 34 percent. Jowers' cost of capital is%. (Round to three decimal places.) View an example Etext pages Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts