Question: = Homework: Assignment 7 Question 7, P8-32 (similar to) > HW Score: 0%, 0 of 8 points O Points: 0 of 1 Save Reward-to-risk ratio.

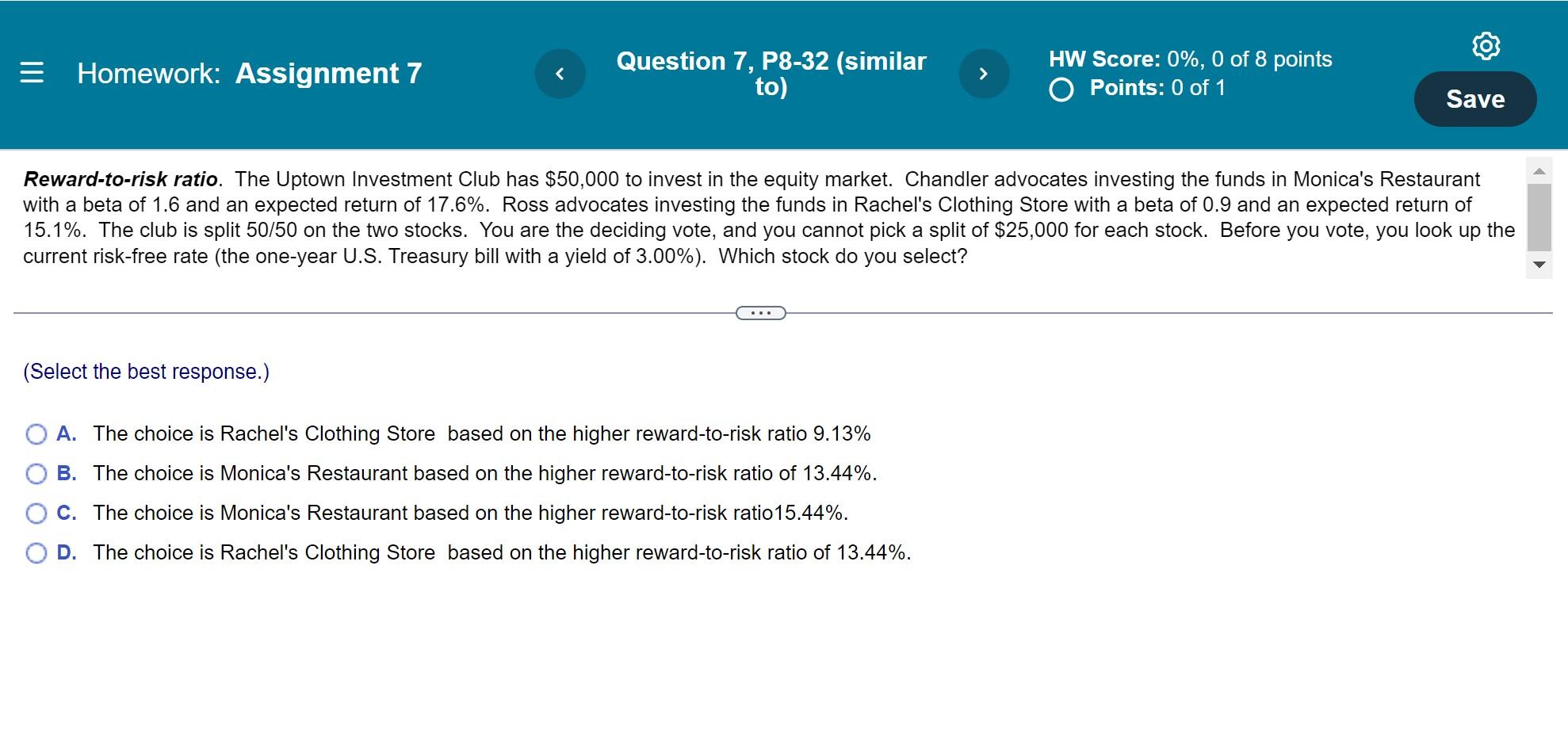

= Homework: Assignment 7 Question 7, P8-32 (similar to) > HW Score: 0%, 0 of 8 points O Points: 0 of 1 Save Reward-to-risk ratio. The Uptown Investment Club has $50,000 to invest in the equity market. Chandler advocates investing the funds in Monica's Restaurant with a beta of 1.6 and an expected return of 17.6%. Ross advocates investing the funds in Rachel's Clothing Store with a beta of 0.9 and an expected return of 15.1%. The club is split 50/50 on the two stocks. You are the deciding vote, and you cannot pick a split of $25,000 for each stock. Before you vote, you look up the current risk-free rate (the one-year U.S. Treasury bill with a yield of 3.00%). Which stock do you select? ... (Select the best response.) O A. The choice is Rachel's Clothing Store based on the higher reward-to-risk ratio 9.13% B. The choice is Monica's Restaurant based on the higher reward-to-risk ratio of 13.44%. OC. The choice is Monica's Restaurant based on the higher reward-to-risk ratio 15.44%. OD. The choice is Rachel's Clothing Store based on the higher reward-to-risk ratio of 13.44%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts