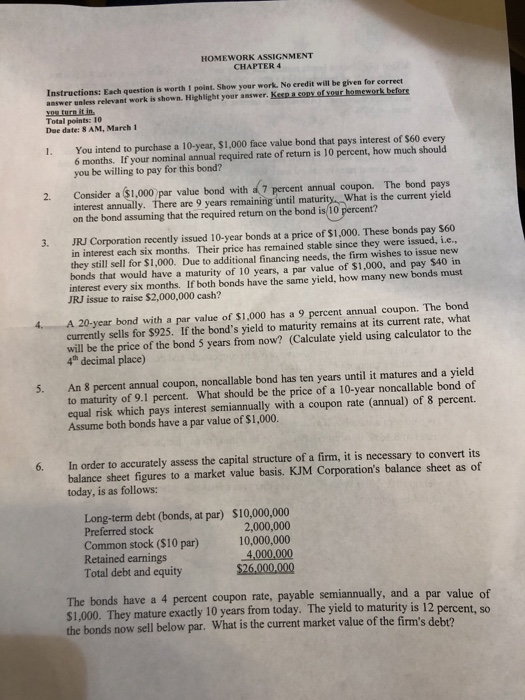

Question: HOMEWORK ASSIGNMENT CHAPTER 4 Instructions: Each question is worth 1 point. Show your work. No eredit will be given for correct Total points: 10 Due

HOMEWORK ASSIGNMENT CHAPTER 4 Instructions: Each question is worth 1 point. Show your work. No eredit will be given for correct Total points: 10 Due date: 8 AM, March 1 1. You intend to purchase a 10-year, $1,000 face value bond that pays interest of $60 every 6 months. If your nominal annual required rate of return is 10 percent, how much should you be willing to pay for this bond? 2. Consider a ($1,000 par value bond with d7 percent annual coupon. The bond pays interest annually. There are 9 years remaining until maturity What is the current yield on the bond assuming that the required retum on the bond is 10 percent? 3. JRJ Corporation recently issued 10-year bonds at a price of $1,000. These bonds pay $60 in interest each six months. Their price has remained stable since they were issued, i.e., they still sell for $1,000. Due to additional financing needs, the firm wishes to issue new bonds that would have a maturity of 10 years, a par value of $1,000, and pay $40 in interest every six months. If both bonds have the same yield, how many new bonds must JRJ issue to raise $2,000,000 cash? A 20-year bond with a par value of $1,000 has a 9 percent annual coupon. The bond currently sells for $925. If the bond's yield to maturity remains at its current rate, what will be the price of the bond 5 years from now? (Calculate yield using calculator to the 4h decimal place) An 8 percent annual coupon, noncallable bond has ten years until it matures and a yield to maturity of 9.1 percent. What should be the price of a 10-year noncallable bond of equal risk which pays interest semiannually with a coupon rate (annual) of 8 percent. Assume both bonds have a par value of $1,000 5. 6. In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures to a market value basis. KJM Corporation's balance sheet as of today, is as follows: Long-term debt (bonds, at par) $10,000,000 Preferred stock Common stock ($10 par) 10,000,000 Retained earnings Total debt and equity 2,000,000 4,000,000 $26.000,000 The bonds have a 4 percent coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12 the bonds now sell below par. What is the current market value of the firm's debt? percent, so

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts