Question: = Homework: Assignment Chapter 9 Question 5, P9-10 (simil... Part 2 of 2 HW Score: 30%, 3 of 10 points O Points: 0 of 2

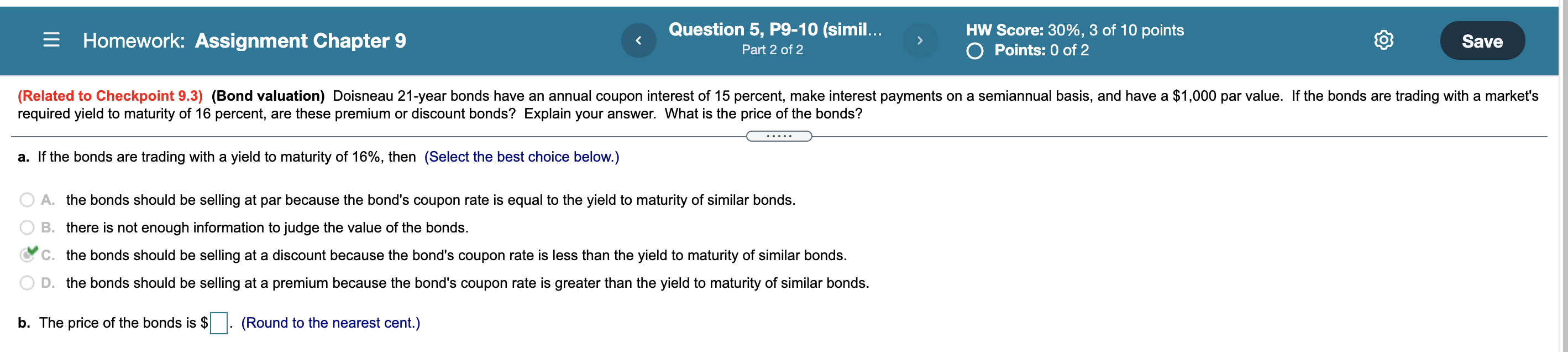

= Homework: Assignment Chapter 9 Question 5, P9-10 (simil... Part 2 of 2 HW Score: 30%, 3 of 10 points O Points: 0 of 2 Save (Related to Checkpoint 9.3) (Bond valuation) Doisneau 21-year bonds have an annual coupon interest of 15 percent, make interest payments on a semiannual basis, and have a $1,000 par value. If the bonds are trading with a market's required yield to maturity of 16 percent, are these premium or discount bonds? Explain your answer. What is the price of the bonds? a. If the bonds are trading with a yield to maturity of 16%, then (Select the best choice below.) A. the bonds should be selling at par because the bond's coupon rate is equal to the yield to maturity of similar bonds. B. there is not enough information to judge the value of the bonds. C. the bonds should be selling at a discount because the bond's coupon rate is less than the yield to maturity of similar bonds. D. the bonds should be selling at a premium because the bond's coupon rate is greater than the yield to maturity of similar bonds. b. The price of the bonds is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts