Question: Homework - Ch 10 0 Saved Help Save 8. Exit Submit .E You received no credit for this question in the previous attempt. 8 Required

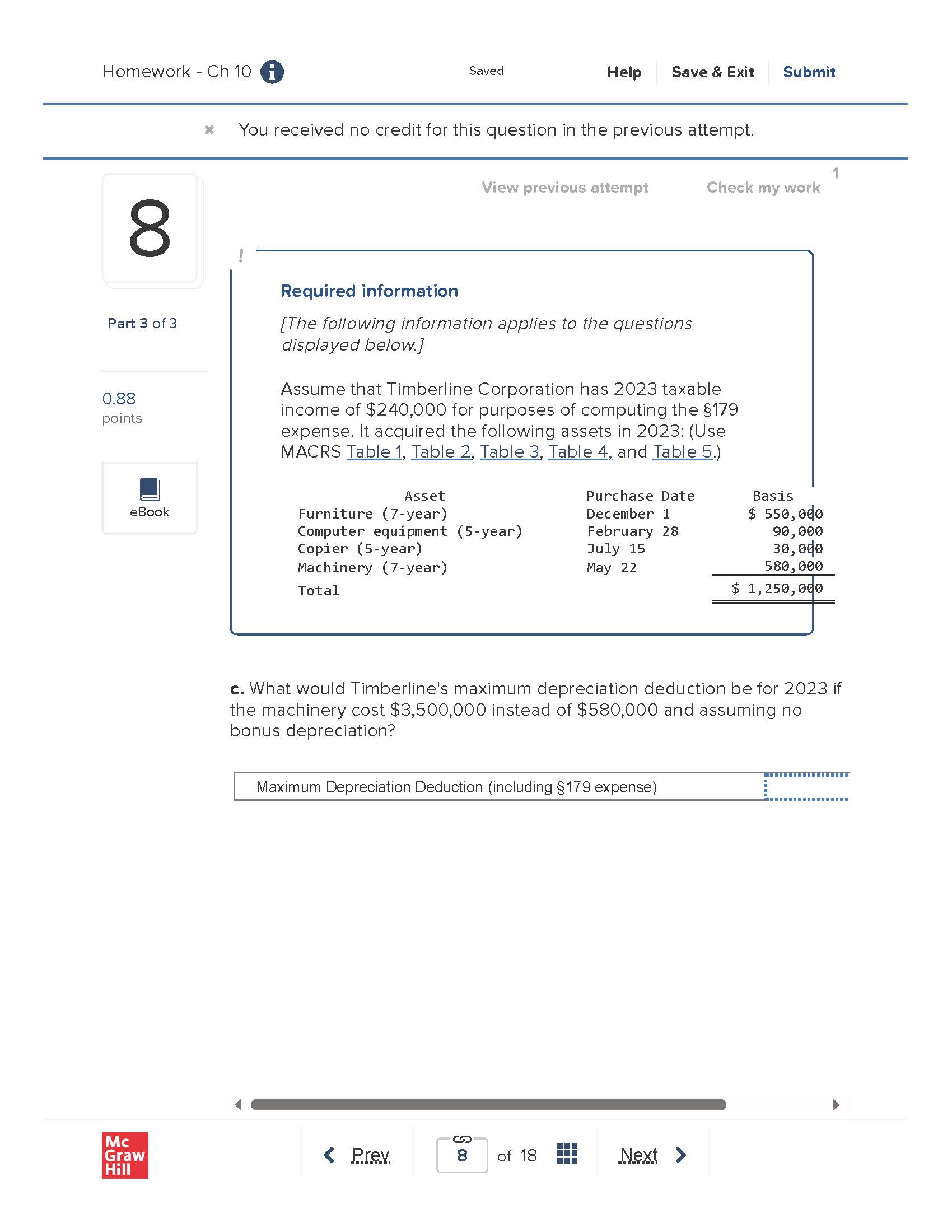

Homework - Ch 10 0 Saved Help Save 8. Exit Submit .E You received no credit for this question in the previous attempt. 8 Required information Part 3 of3 [The following information applies to the questions displayed beiow] O 88 Assume that Timberline Corporation has 2023 taxable pC'JimS income of $240,000 for purposes of computing the 179 expense. lt acquired the following assets in 2023: (Use MACRS Table 'I, Table 2, Table 3, Table 4, and Table 5.) El Asset Purchase Date Basis SBOOk Furniture (7-year) December 1 $ 559,999 Computer equipment (S-year) February 28 99,999 Copier (Syear) July 15 39,999 Machinery (7-year) May 22 589,999 Total $ 1,259,9 9 c. What would Timberline's maximum depreciation deduction be for 2023 if the machinery cost $3,500,000 instead of $580,000 and assuming no bonus depreciation? Maximum Depreciation Deduction (including 179 expense) %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts