Question: = Homework: Ch 12 Homework B - Graded Question 3, EF12-17 (similar to) Part 1 of 3 HW Score: 0%, 0 of 44 points

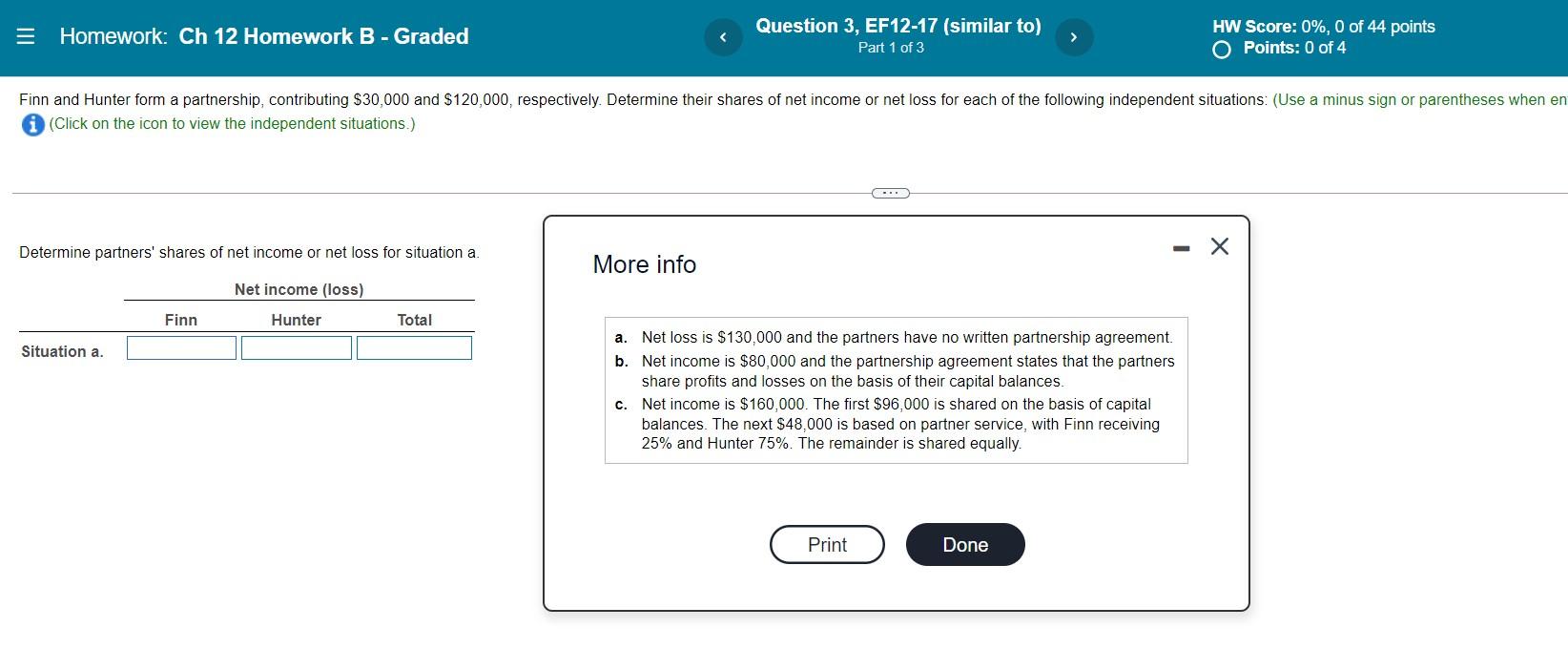

= Homework: Ch 12 Homework B - Graded Question 3, EF12-17 (similar to) Part 1 of 3 HW Score: 0%, 0 of 44 points O Points: 0 of 4 Finn and Hunter form a partnership, contributing $30,000 and $120,000, respectively. Determine their shares of net income or net loss for each of the following independent situations: (Use a minus sign or parentheses when en (Click on the icon to view the independent situations.) Determine partners' shares of net income or net loss for situation a. More info Finn Situation a. Net income (loss) Hunter Total a. Net loss is $130,000 and the partners have no written partnership agreement. b. Net income is $80,000 and the partnership agreement states that the partners share profits and losses on the basis of their capital balances. c. Net income is $160,000. The first $96,000 is shared on the basis of capital balances. The next $48,000 is based on partner service, with Finn receiving 25% and Hunter 75%. The remainder is shared equally. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts