Question: Homework Ch 15 A Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work

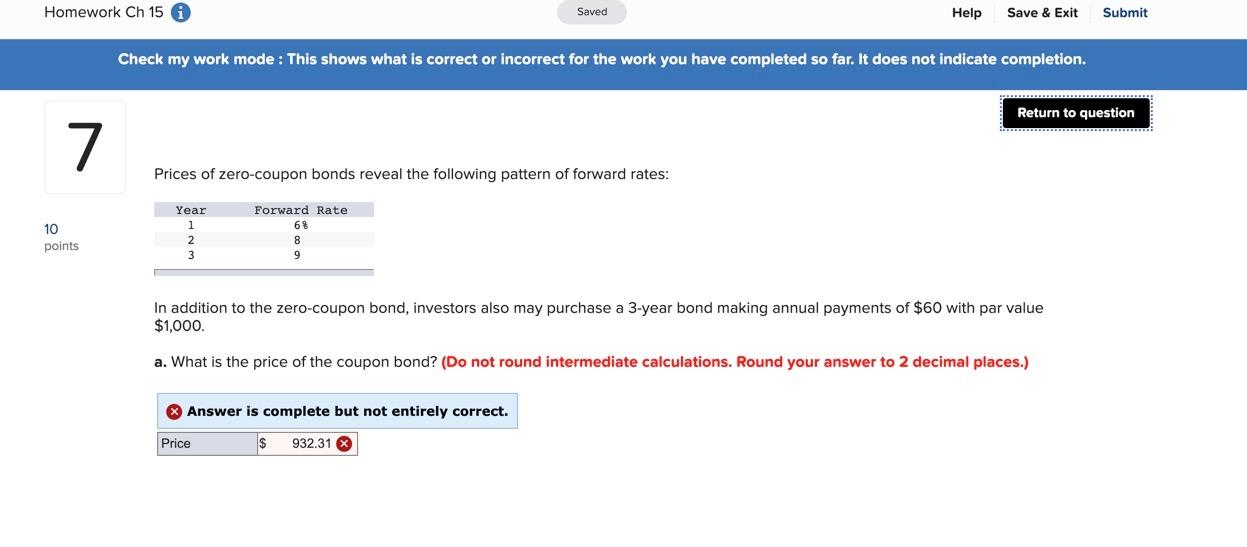

Homework Ch 15 A Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 7 Prices of zero-coupon bonds reveal the following pattern of forward rates: 10 points Year 1 2 3 Forward Rate 6% 8 9 In addition to the zero-coupon bond, investors also may purchase a 3-year bond making annual payments of $60 with par value $1,000. a. What is the price of the coupon bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) X Answer is complete but not entirely correct. Price $ 932.31 X Suppose that today's date is April 15. A bond with a 9.5% coupon paid semiannually every January 15 and July 15 is quoted as selling at an ask price of 101.38. If you buy the bond from a dealer today, what price will you pay for it? (Round your answer to 2 decimal places.) Invoice price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts