Question: @ Homework: Ch 4 (Part II) HW Assignment - FIN 300 SPRING 2022 Question 5, P 4-41 (book/static) Part 1 of 3 HW Score: 84.06%,

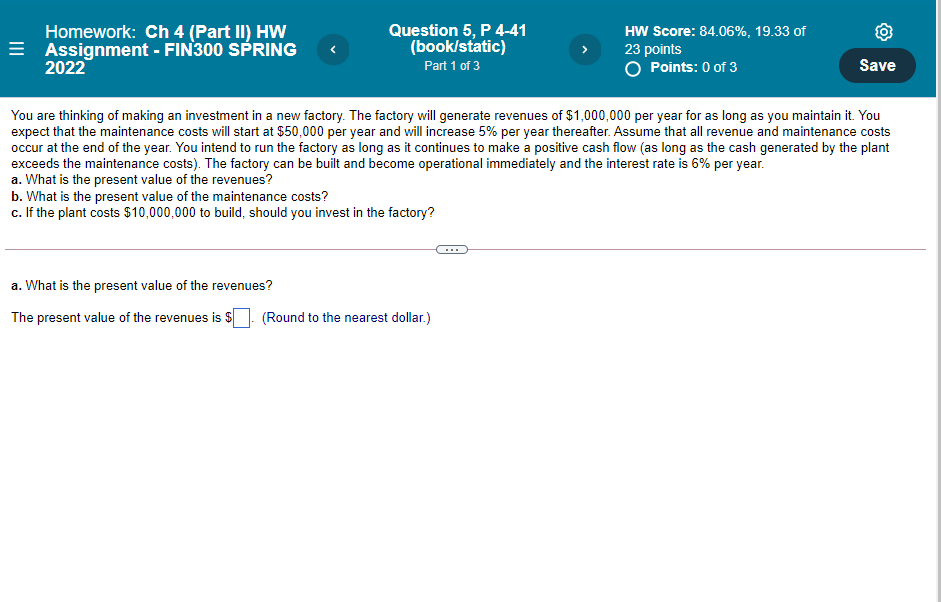

@ Homework: Ch 4 (Part II) HW Assignment - FIN 300 SPRING 2022 Question 5, P 4-41 (book/static) Part 1 of 3 HW Score: 84.06%, 19.33 of 23 points O Points: 0 of 3 Save You are thinking of making an investment in a new factory. The factory will generate revenues of $1,000,000 per year for as long as you maintain it. You expect that the maintenance costs will start at $50,000 per year and will increase 5% per year thereafter. Assume that all revenue and maintenance costs occur at the end of the year. You intend to run the factory as long as it continues to make a positive cash flow (as long as the cash generated by the plant exceeds the maintenance costs). The factory can be built and become operational immediately and the interest rate is 6% per year. a. What is the present value of the revenues? b. What is the present value of the maintenance costs? c. If the plant costs $10,000,000 to build, should you invest in the factory? a. What is the present value of the revenues? The present value of the revenues is $[ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts