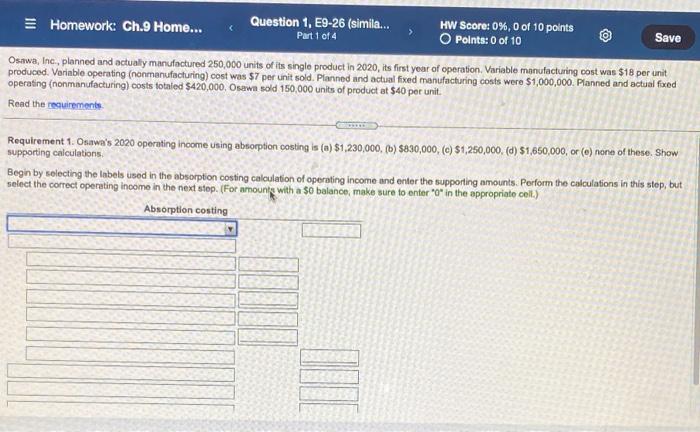

Question: Homework: Ch.9 Home... Question 1, E9-26 (simila... HW Score: 0%, 0 of 10 points Part 1 of 4 Polnts: 0 of 10 Save Osawa, Inc.,

Homework: Ch.9 Home... Question 1, E9-26 (simila... HW Score: 0%, 0 of 10 points Part 1 of 4 Polnts: 0 of 10 Save Osawa, Inc., planned and actually manufactured 250,000 units of its single product in 2020, its first year of operation. Variable manufacturing cost was $18 per unit produced. Variable operating (nonmanufacturing) cost was $7 per unit sold. Planned and actual fixed manufacturing costs were $1,000,000. Planned and actual fixed operating (nonmanufacturing) costs totaled $420,000, sewn sold 150,000 units of product at $40 per unit. Read the resuirements Requirement 1. Osawa's 2020 operating income using absorption costing is (a) $1,230,000. (b) $830,000, (C) $1,250,000. (d) $1,650,000, or (e) none of these. Show supporting calculations Begin by selecting the labels used in the absorption costing calculation of operating income and enter the supporting amounts. Perform the calculations in this step, but select the correct operating income in the next stop. (For amount with a $0 balance, make sure to enter *O* in the appropriate coll.) Absorption costing Requirements 1. Osawa's 2020 operating income using absorption costing is (a) $1,230,000, (b) $830,000, (c) $1,250,000, (d) $1,650,000, or (e) none of these. Show supporting calculations. 2. Osawa's 2020 operating income using variable costing is (a) $1,830,000, (b) $1,230,000, (c) $830,000, (d) $1,250,000, or (e) none of these. Show supporting calculations. Print Done MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts