Question: Homework: Chapt. 10 - Capital Budgeting Techniques Question 3, P10-11 (similar to) Part 1 of 2 HW Score: 2.78%, 0.33 of 12 points Points: 0

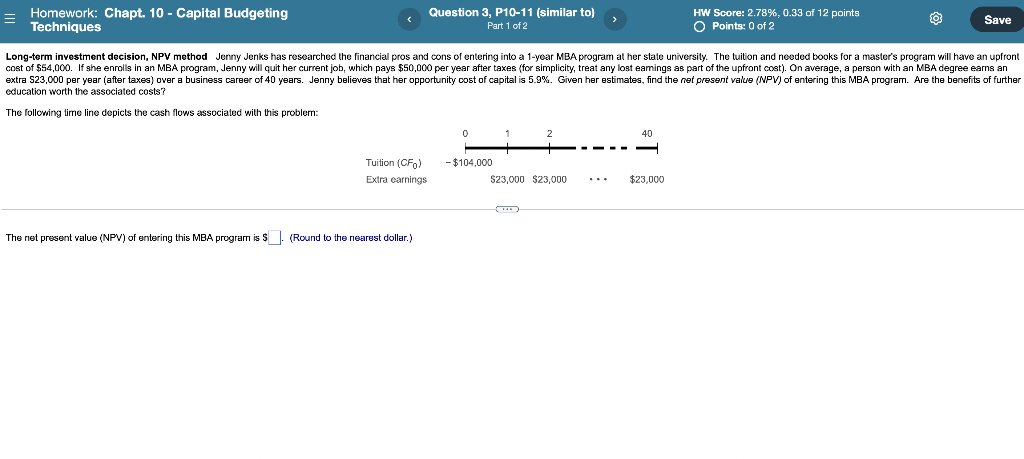

Homework: Chapt. 10 - Capital Budgeting Techniques Question 3, P10-11 (similar to) Part 1 of 2 HW Score: 2.78%, 0.33 of 12 points Points: 0 of 2 Save Long-term investment decision, NPV method Jenny Jenks has researched the financial pros and cons of entering into a 1-year MBA program at her state university. The tuition and needed books for a master's program will have an upfront cost of $54,000. If she enrolls in an MBA program, Jenny will quit her current job, which pays $50,000 per year after taxes (for simplicity, treat any lost eamings as part of the upfront cost). On average, a person with an MBA degree earns an extra 523,000 per year (after taxes) over a business career of 40 years. Jenny believes that her opportunity cost of capital is 5.9%. Given her estimates, find the net present value (NPV) of entering this MBA program. Are the benefits of further education worth the associated costs? The following time line depicts the cash flows associated with this problem: 0 1 40 Tuition (CF) Extra earnings - $104,000 $23,000 $23,000 $23.000 The net present value (NPV) of entering this MBA program is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts