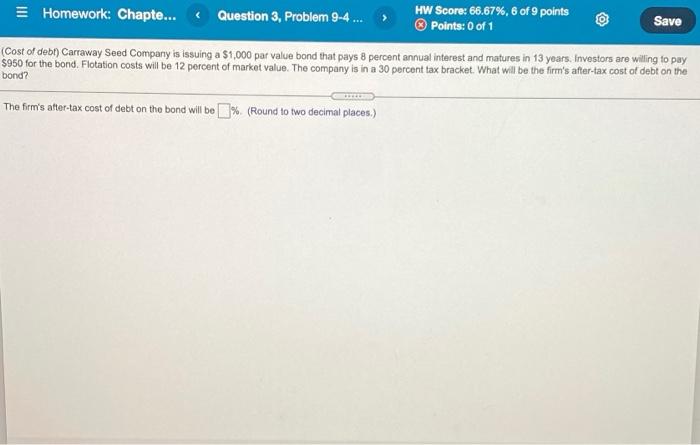

Question: Homework: Chapte... Question 3, Problem 9-4 ... HW Score: 66.67%, 6 of 9 points Points: 0 of 1 Save (Cost of debt) Carraway Seed Company

Homework: Chapte... Question 3, Problem 9-4 ... HW Score: 66.67%, 6 of 9 points Points: 0 of 1 Save (Cost of debt) Carraway Seed Company is issuing a $1,000 par value bond that pays 8 percent annual interest and matures in 13 years. Investors are willing to pay $950 for the bond. Flotation costs will be 12 percent of market value. The company is in a 30 percent tax bracket. What will be the firm's after-tax cost of debt on the bond? The firm's after-tax cost of debt on the bond will be % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts