Question: Homework: Chapter 10. Learning Objective 1. Topic Homework 1 Save ! Score: 0 of 1 pt 1 of 4 (2 complete) HW Score: 50%, 2

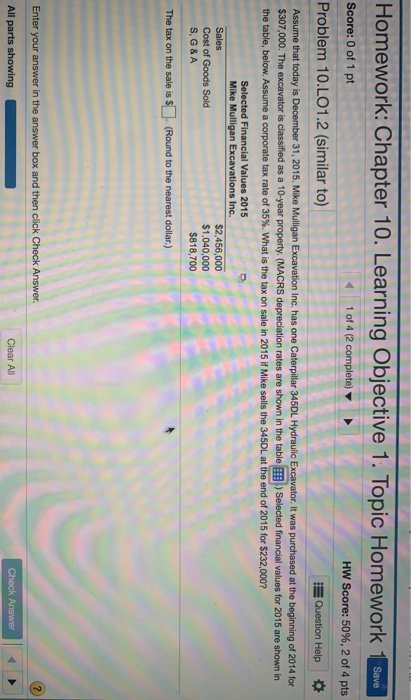

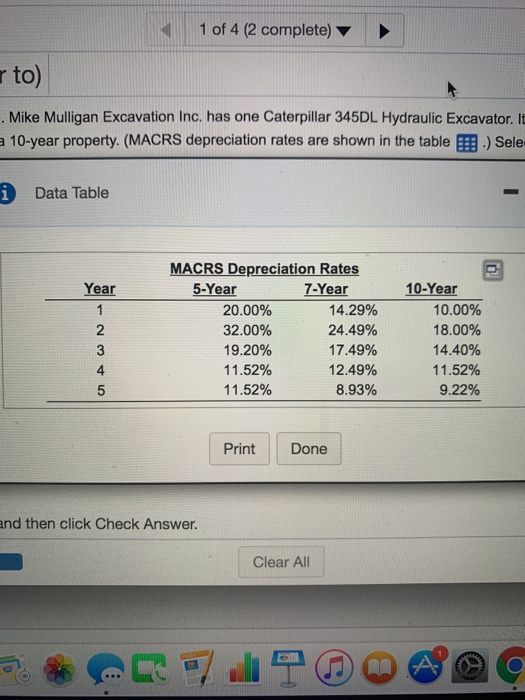

Homework: Chapter 10. Learning Objective 1. Topic Homework 1 Save ! Score: 0 of 1 pt 1 of 4 (2 complete) HW Score: 50%, 2 of 4 pts Problem 10.LO1.2 (similar to) Question Help Assume that today is December 31, 2015. Mike Mulligan Excavation Inc. has one Caterpillar 345DL Hydraulic Excavator. It was purchased at the beginning of 2014 for $307,000. The excavator is classified as a 10-year property. (MACRS depreciation rates are shown in the table Selected financial values for 2015 are shown in the table, below. Assume a corporate tax rate of 35%. What is the tax on sale in 2015 if Mike sells the 345DL at the end of 2015 for $232,000? Selected Financial Values 2015 Mike Mulligan Excavations Inc. Sales Cost of Goods Sold $2.456,000 $1,040,000 $818,700 S, G&A The tax on the sale is $ (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. Clear All Check Answer 1 of 4 (2 complete) rto) . Mike Mulligan Excavation Inc. has one Caterpillar 345DL Hydraulic Excavator. It a 10-year property. (MACRS depreciation rates are shown in the table .) Sele i Data Table Year AWN MACRS Depreciation Rates 5-Year 7-Year 20.00% 14.29% 32.00% 24.49% 19.20% 17.49% 11.52% 12.49% 11.52% 8.93% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% Print Done ind then click Check Answer. Clear All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts