Question: = Homework: Chapter 13 Homework Question 1, P 13-1 (similar to) Part 1 of 3 > HW Score: 0%, 0 of 6 points O Points:

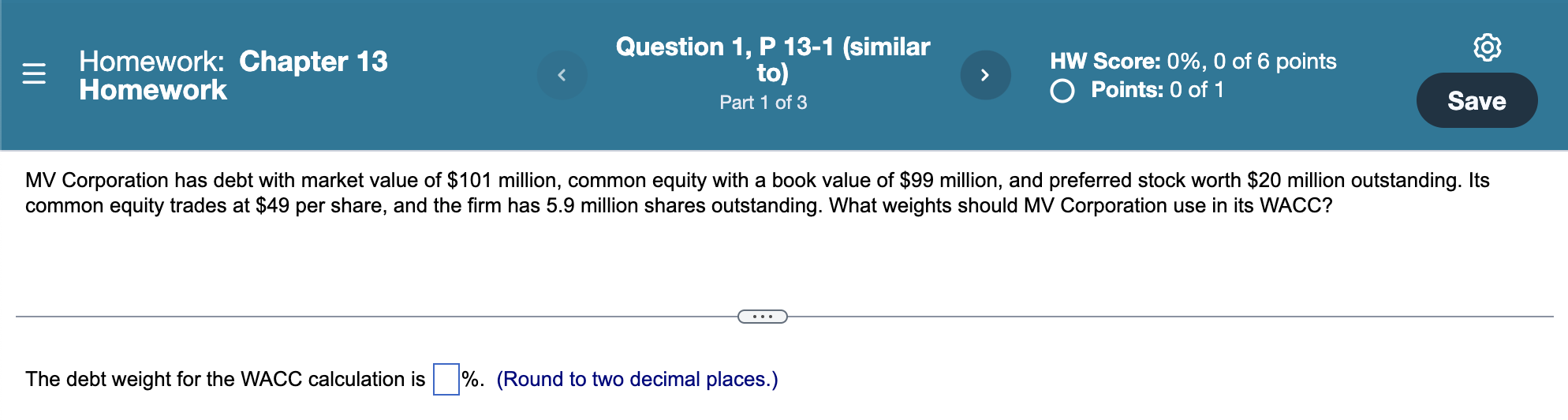

= Homework: Chapter 13 Homework Question 1, P 13-1 (similar to) Part 1 of 3 > HW Score: 0%, 0 of 6 points O Points: 0 of 1 Save MV Corporation has debt with market value of $101 million, common equity with a book value of $99 million, and preferred stock worth $20 million outstanding. Its common equity trades at $49 per share, and the firm has 5.9 million shares outstanding. What weights should MV Corporation use in its WACC? The debt weight for the WACC calculation is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock