Question: Homework Chapter 13C Homework Saved Help Save & Exit Submit Check my work Winthrop Company has an opportunity to manufacture and sell a new product

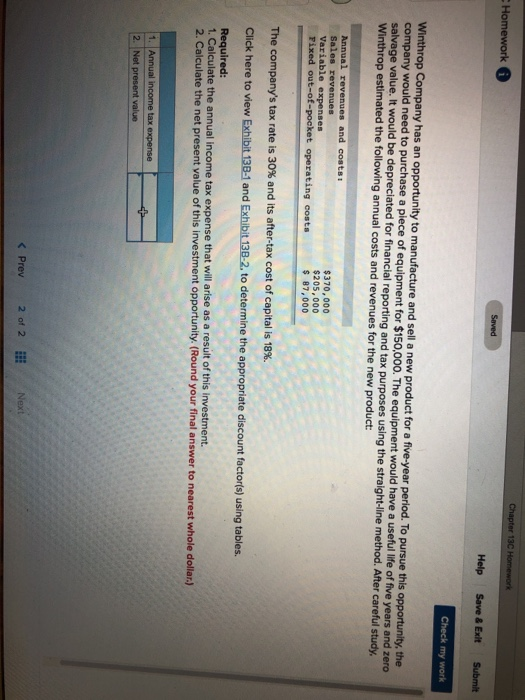

Homework Chapter 13C Homework Saved Help Save & Exit Submit Check my work Winthrop Company has an opportunity to manufacture and sell a new product for a five-year period. To pursue this opportunity, the company would need to purchase a piece of equipment for $150,000. The equipment would have a useful life of five years and zero salvage value. It would be depreciated for financial reporting and tax purposes using the straight-line method. After careful study. Winthrop estimated the following annual costs and revenues for the new product: Annual revenues and costs! Sales revenues Variable expenses Pixed out-of-pocket operating costs $370,000 $205,000 $ 87,000 The company's tax rate is 30% and its after-tax cost of capital is 18%. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate the annual income tax expense that will arise as a result of this investment 2. Calculate the net present value of this investment opportunity. (Round your final answer to nearest whole dollar. 1. Annual income tax expense 2. Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts