Question: = Homework: Chapter 14 Homework Question 8, P14-14 (simi... Part 1 of 4 HW Score: 10%, 1 of 10 points O Points: 0 of 1

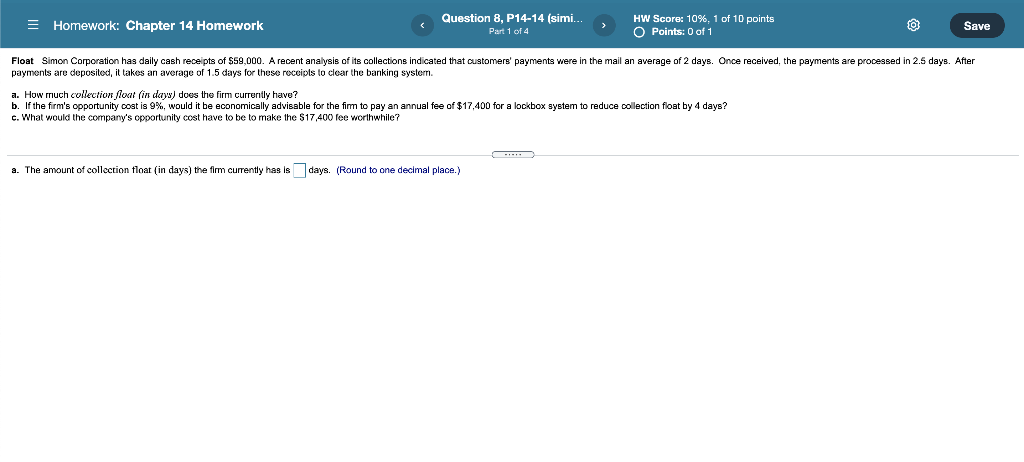

= Homework: Chapter 14 Homework Question 8, P14-14 (simi... Part 1 of 4 HW Score: 10%, 1 of 10 points O Points: 0 of 1 @ Save Float Simon Corporation has daily cash receipts of $59,000. A recent analysis of its collections indicated that customers' payments were in the mail an average of 2 days. Once received, the payments are processed in 2.5 days. After payments are deposited, it takes an average of 1.5 days for these receipts to clear the banking system. a. How much collection float (in days) does the firm currently have? b. If the firm's opportunity cost is 9%, would it be economically advisable for the firm to pay an annual fee of $17,400 for a lockbox system to reduce collection float by 4 days? c. What would the company's opportunity cost have to be to make the $17,400 fee worthwhile? a. The amount of collection float (in days) the firm currently has is days. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts