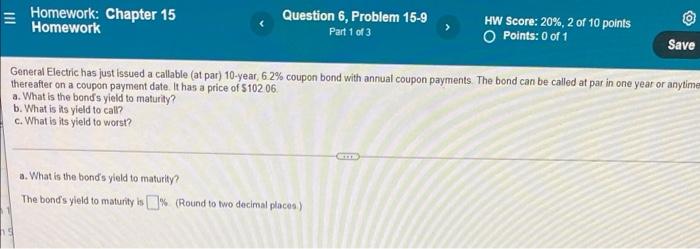

Question: = Homework: Chapter 15 Homework Question 6, Problem 15-9 Part 1 of 3 > HW Score: 20%, 2 of 10 points O Points: 0 of

= Homework: Chapter 15 Homework Question 6, Problem 15-9 Part 1 of 3 > HW Score: 20%, 2 of 10 points O Points: 0 of 1 Save General Electric has just issued a callable (at par) 10-year 6 2% coupon bond with annual coupon payments. The bond can be called at par in one year or anytime thereafter on a coupon payment date. It has a price of 5102 06. a. What is the band's yield to maturity? b. What is its yield to call? c. What is its yield to worst? a. What is the bond's yield to maturity The bond's yield to maturity is % (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts