Question: = Homework: Chapter 3 Homework Question 12, P3-26 (simil... Part 1 of 14 HW Score: 41.93%, 5.09 of 12 points Points: 0 of 1 :

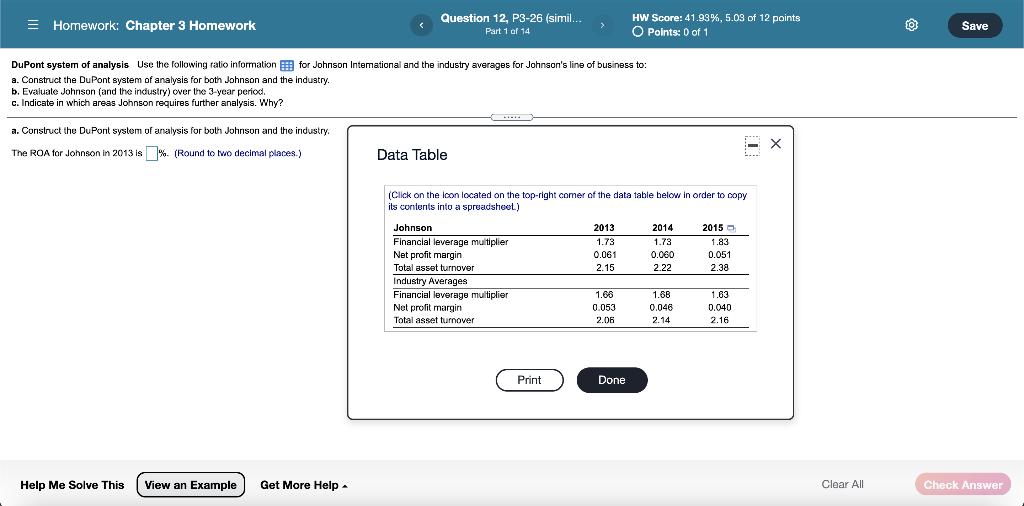

= Homework: Chapter 3 Homework Question 12, P3-26 (simil... Part 1 of 14 HW Score: 41.93%, 5.09 of 12 points Points: 0 of 1 : 1 Save DuPont system of analysis Use the following ratio information for Johnson Intemational and the industry averages for Johnson's line of business to: a. Construct the DuPont system of analysis for both Johnson and the industry. b. Evaluate Johnson (and the industry) over the 3-year period. c. Indicate in which areas Johnson requires further analysis. Why? a. Construct the DuPont system of analysis for both Johnson and the industry. The ROA for Johnson in 2013 is % (Round to two decimal places.) Data Table (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Johnson 2013 2014 2015 Financial leverage multiplier 1.73 1.73 1.83 Net profit margin 0.061 0.060 0.051 Total asset turnover 2.15 2.22 2.38 Industry Averages Financial leverage multiplier 1.66 1.68 1.63 Net profit margin 0.053 0.046 0.040 Total asset turnover 2.06 2.14 2.16 Print Print Done Help Me Solve This View an Example Get More Help Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts