Question: Homework: Chapter 3 HW Sav HW Score: 97.5 % , 39 of 40 7 of 13 (13 complete)v Score: 2 of 3 pts % PI:3-37

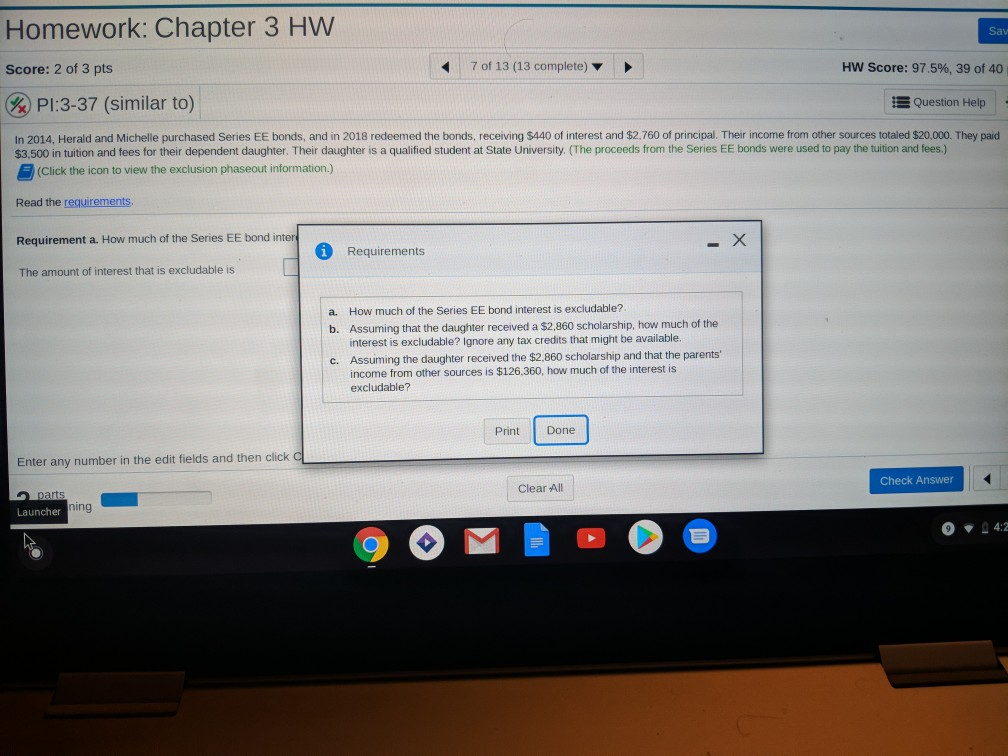

Homework: Chapter 3 HW Sav HW Score: 97.5 % , 39 of 40 7 of 13 (13 complete)v Score: 2 of 3 pts % PI:3-37 (similar to) EQuestion Help 2014. Herald and Michelle purchased Series EE bonds, and in 2018 redeemed the bonds, receiving $440 $3,500 in tuition and fees for their dependent daughter. Their daughter is a qualified student f interest and $2,760 of principal. Their income from other sources totaled $20,000. They paid State University. (The proceeds from the Series EE bonds were used to pay the tuition and fees.) o view the exclusion phaseout information.) (Click the icon Read the requirements. f the Series EE bond intere X Requirement a. How much Requirements The amount of interest that is excludable is excludable? How much of the Series EE bond interest a Assuming that the daughter received a $2,860 scholarship, how much of the interest is excludable? Ignore any tax credits that might be available. b. Assuming the daughter received the $2,860 scholarship and that the parents" income from other sources is $126,360, how much of the interest is C excludable? Done Print Enter any number in the edit fields and then click C Check Answer Clear All parts ning Launcher Homework: Chapter 3 HW Sav HW Score: 97.5 % , 39 of 40 7 of 13 (13 complete)v Score: 2 of 3 pts % PI:3-37 (similar to) EQuestion Help 2014. Herald and Michelle purchased Series EE bonds, and in 2018 redeemed the bonds, receiving $440 $3,500 in tuition and fees for their dependent daughter. Their daughter is a qualified student f interest and $2,760 of principal. Their income from other sources totaled $20,000. They paid State University. (The proceeds from the Series EE bonds were used to pay the tuition and fees.) o view the exclusion phaseout information.) (Click the icon Read the requirements. f the Series EE bond intere X Requirement a. How much Requirements The amount of interest that is excludable is excludable? How much of the Series EE bond interest a Assuming that the daughter received a $2,860 scholarship, how much of the interest is excludable? Ignore any tax credits that might be available. b. Assuming the daughter received the $2,860 scholarship and that the parents" income from other sources is $126,360, how much of the interest is C excludable? Done Print Enter any number in the edit fields and then click C Check Answer Clear All parts ning Launcher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts