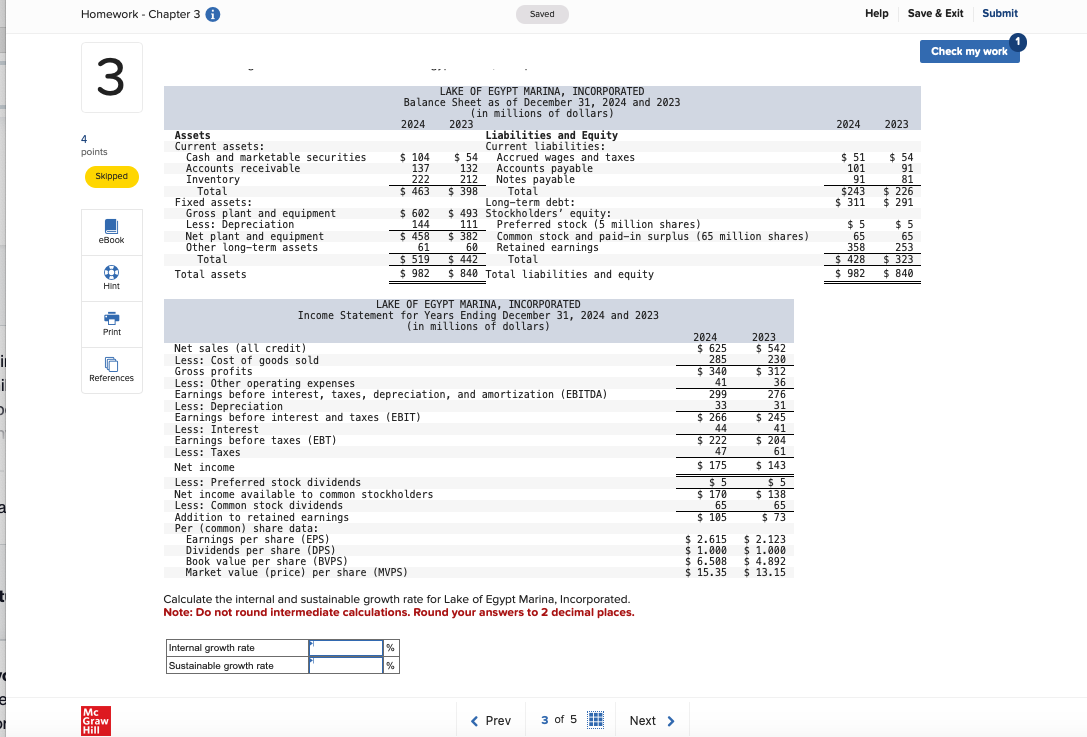

Question: Homework - Chapter 3 Saved 4 points Skipped References LAKE OF EGYPT MARINA, INCORPORATED Balance Sheet as of December 31, 2824 and 20823 {in millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts