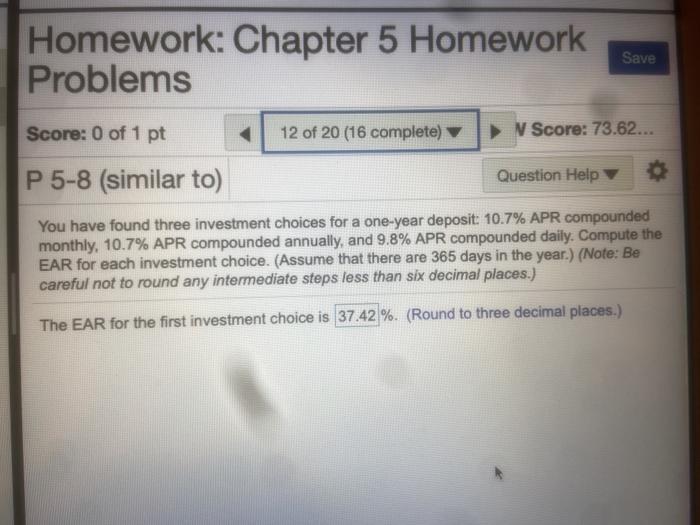

Question: Homework: Chapter 5 Homework Problems Save Score: 0 of 1 pt 12 of 20 (16 complete) V Score: 73.62... P 5-8 (similar to) Question Help

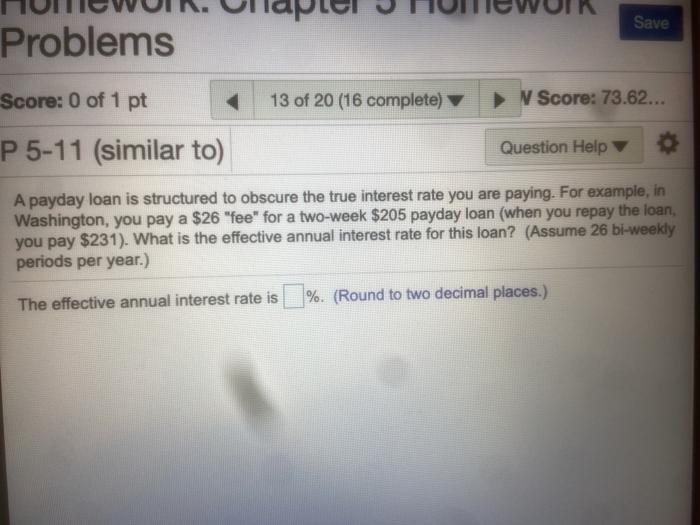

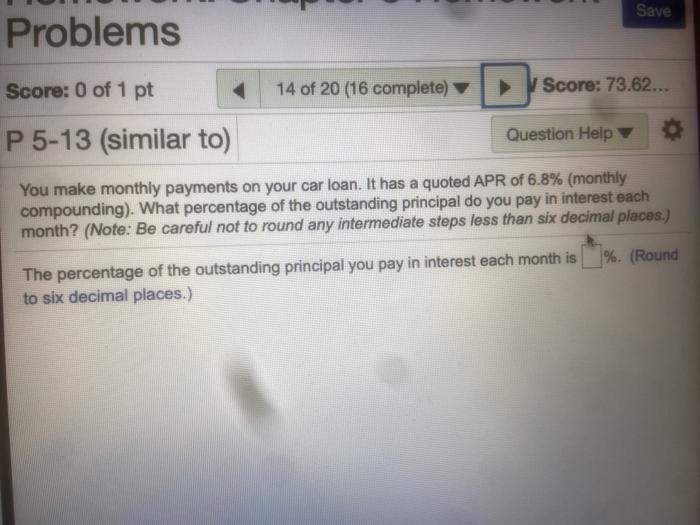

Homework: Chapter 5 Homework Problems Save Score: 0 of 1 pt 12 of 20 (16 complete) V Score: 73.62... P 5-8 (similar to) Question Help You have found three investment choices for a one-year deposit: 10.7% APR compounded monthly, 10.7% APR compounded annually, and 9.8% APR compounded daily. Compute the EAR for each investment choice. (Assume that there are 365 days in the year.) (Note: Be careful not to round any intermediate steps less than six decimal places.) The EAR for the first investment choice is 37.42 %. (Round to three decimal places.) Save Problems Score: 0 of 1 pt 13 of 20 (16 complete) N Score: 73.62... P 5-11 (similar to) Question Help A payday loan is structured to obscure the true interest rate you are paying. For example, in Washington, you pay a $26 "fee" for a two-week $205 payday loan (when you repay the loan, you pay $231). What is the effective annual interest rate for this loan? (Assume 26 bi-weekly periods per year.) The effective annual interest rate is %. (Round to two decimal places.) Save Problems Score: 0 of 1 pt 14 of 20 (16 complete) Score: 73.62... P 5-13 (similar to) Question Help You make monthly payments on your car loan. It has a quoted APR of 6.8% (monthly compounding). What percentage of the outstanding principal do you pay in interest each month? (Note: Be careful not to round any intermediate steps less than six decimal places.) %. (Round The percentage of the outstanding principal you pay in interest each month is to six decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts