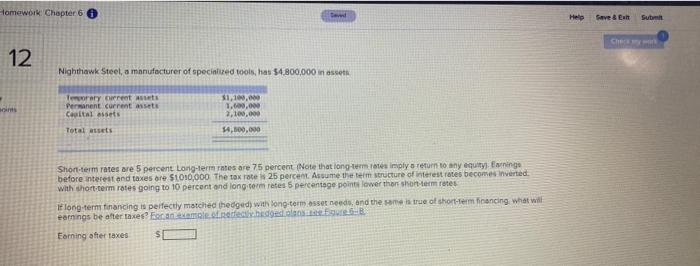

Question: Homework Chapter 6 6 Help Save Eur Sub 12 Nighthawk Steel, a manufacturer of specialized tools, has 54.800,000 in assets Torary cut Permanent current att

Homework Chapter 6 6 Help Save Eur Sub 12 Nighthawk Steel, a manufacturer of specialized tools, has 54.800,000 in assets Torary cut Permanent current att Capital assets $1,100,000 1.000.000 7,100,000 54,800,000 Total Short-term rates are 5 percent Long-term rates are 75 percent (Note that long-term simply return to any equity Ewingo before interest and taxes are $t010,000 The tax rate 25 percent. Assume the term structure of interest rates becomes inverted, with short term rates going to 10 percent and long term etes 5 percentage points lower than shon-term rates If long-term financing is perfectly matched thedged with long-term asset needs, and the come true of short-term financing what will earnings be after the Exam Reedly hedge Earning after taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts