Question: Homework Chapter 6 eBook 1. BE.06.19.ALGO Inventory Costing Methods 2. BE.06.20. ALGO Tyler Company has the following information related to purchases and sales of one

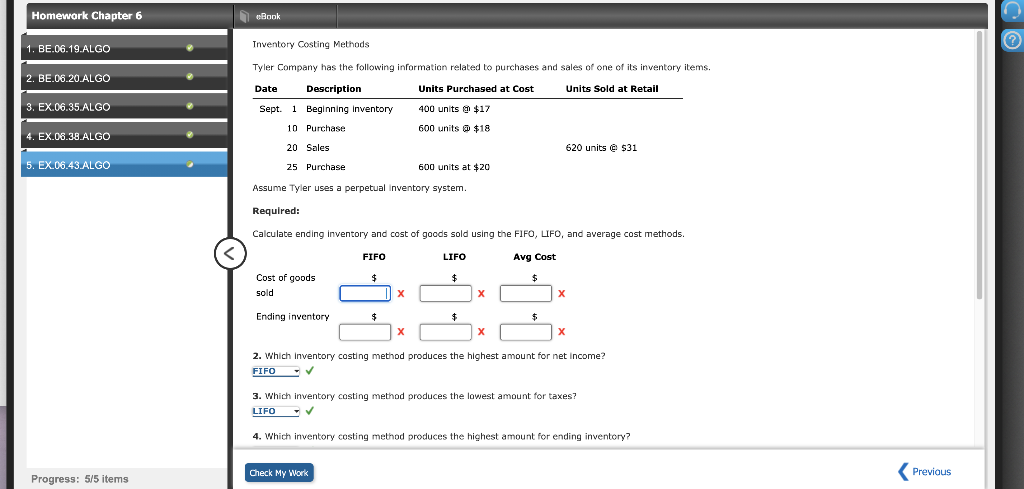

Homework Chapter 6 eBook 1. BE.06.19.ALGO Inventory Costing Methods 2. BE.06.20. ALGO Tyler Company has the following information related to purchases and sales of one of its inventory items. Date Description Units Purchased at Cost Units Sold at Retail Sept. 1 Beginning Inventory 400 units @ $17 @ 10 Purchase 600 units @ $18 3. EX.06.35.ALGO .EX.08.38.ALGO 20 Sales 620 units @ $31 5. EX.06.43.ALGO 25 Purchase 600 units at $20 Assume Tyler uses a perpetual Inventory system. Required: Calculate ending inventory and cost of goods sold using the FIFO, LIFO, and average cost methods. FIFO LIFO Avg Cost $ $ $ Cost of goods sold Ending inventory $ $ $ 2. Which Inventory costing method produces the highest amount for net income? FIFO - 3. Which inventory casting method produces the lowest amount for taxes? LIFO 4. Which inventory costing method produces the highest amount for ending inventory? Check My Work Previous Progress: 5/5 items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts