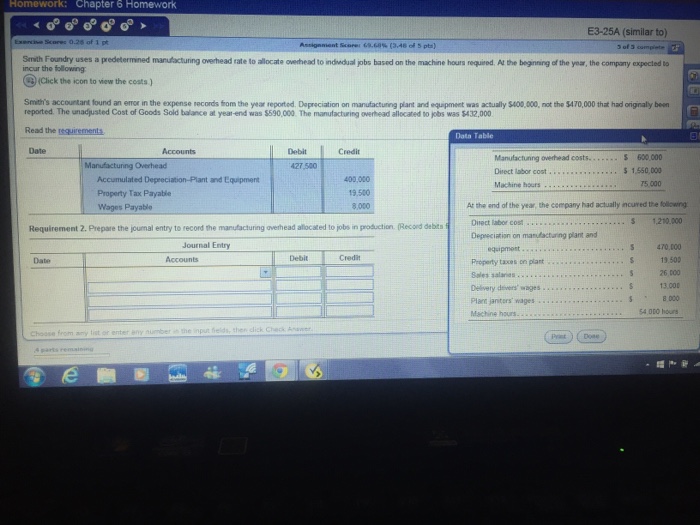

Question: Homework: Chapter 6 Homework E3-25A (similar to) Assignment Scare. GS.ca% (3.46 of 5 pts) 3 of 3 Smith Foundry uses a predetermined manufacturing overhead rate

Homework: Chapter 6 Homework E3-25A (similar to) Assignment Scare. GS.ca% (3.46 of 5 pts) 3 of 3 Smith Foundry uses a predetermined manufacturing overhead rate to allocate ovethead to indsedual jobs based on the machine hours required. At the beginning of the year, the company expected to incur tho following Click the icon to view the costs ) Smithi's accountant found an emor in the expense records from the year reported. Depreciation on manufacturing plant and equipmeet was actually $400,000, not the 5470,000 that had originaly beon reported. The unadjusted Cost of Goods Sold balance at year end was $590,000. The manufacturing overhead allecated to jobs was 54:32,000 Read the tequirements Date Data Table Debit Credit Overhead 427 500 Direct labor cost.... 1,550,000 Accumulated Depeeciation-Plant and Equipment Property Tax Payable Wages Payable 400.000 19.500 8,000 Machine hours T5 000 At the end of the year, the cempany had actualy incured the follcwing s 1,21000 Direct labor cost . Requirement 2. Prepare the joumal entry to record the manufacturing overhead aflocated to jobs in production (Record debt Depseciatian on manudfactuaring plant and Journal Entry 470.100 19500 5 26 000 S13.000 8.000 54 000 hours eqsipment Date Accounts Debit Credit Property taxes on plant Sales salanids Delivery deivers' wages Plant janters' wages Machine hours.- Choose from amy tist or enter eny number the input Pt Doe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts