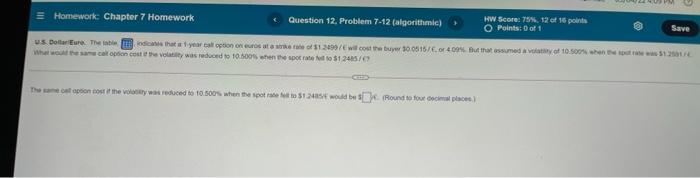

Question: Homework: Chapter 7 Homework Question 12. Problem 7-12 (algorithmic) HW Score: 75%, 12 of 16 points Points: 0 of 1 Save US Dollar Eure The

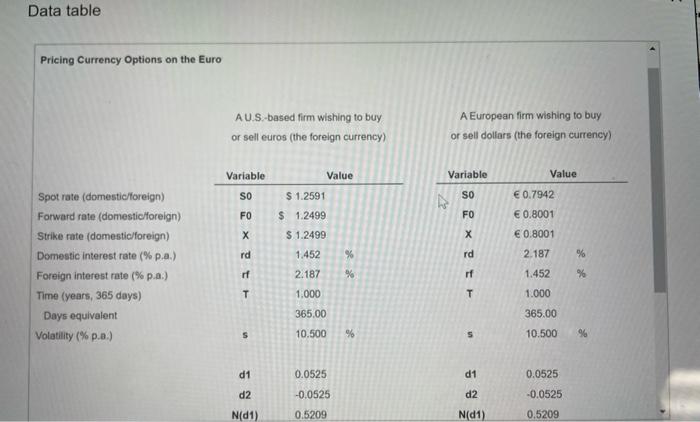

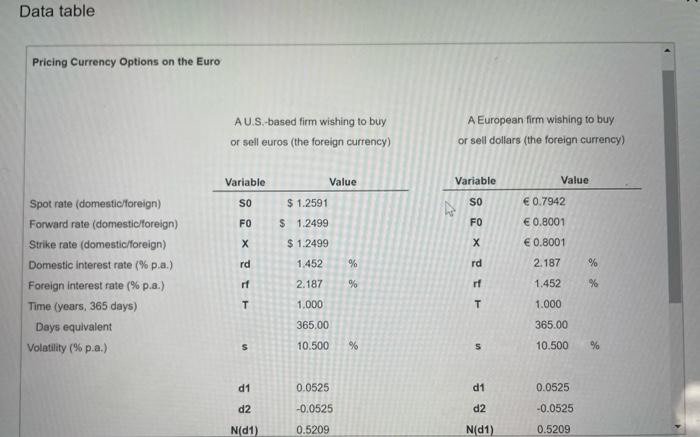

Homework: Chapter 7 Homework Question 12. Problem 7-12 (algorithmic) HW Score: 75%, 12 of 16 points Points: 0 of 1 Save US Dollar Eure The that a year all option on eros ata of 1997will cost the buyer 30.0515/or 40%But that assumed 16.500 150 What the caption cost the way was reduced to 10.800 when the spot to $1245/6 The cul apoion to the reduced to 10.500s when the 100 to 12 would be round to tou ocimal place) Data table Pricing Currency Options on the Euro AU.S.-based firm wishing to buy or sell euros (the foreign currency) A European firm wishing to buy or sell dollars (the foreign currency) Variable Value Variable Value SO $ 1.2591 SO 0.7942 0.8001 FO $ 1.2499 FO x $ 1.2499 1.452 0.8001 2.187 rd % rd % Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (%p.a.) rf % rf 1.452 % = T 1.000 2.187 1.000 365.00 10.500 365.00 10.500 S % 5 96 d1 d1 0.0525 d2 0.0525 -0.0525 0.5209 d2 -0.0525 0.5209 N(D1) N(1) Data table Pricing Currency Options on the Euro AU.S.-based firm wishing to buy or sell euros (the foreign currency) A European firm wishing to buy or sell dollars (the foreign currency) Variable Variable Value $ 1.2591 $ 1.2499 Value 0.7942 SO FO FO 0.8001 0.8001 $ 1.2499 8 x 1 - rd 1.452 % rd 2.187 Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) % rt 2.187 % 1.452 % T 1.000 1.000 365.00 365.00 $ 10.500 % 5 10.500 % d1 0.0525 d1 0.0525 d2 -0.0525 d2 -0.0525 Nd1) & 0.5209 Nid1) 0.5209

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts