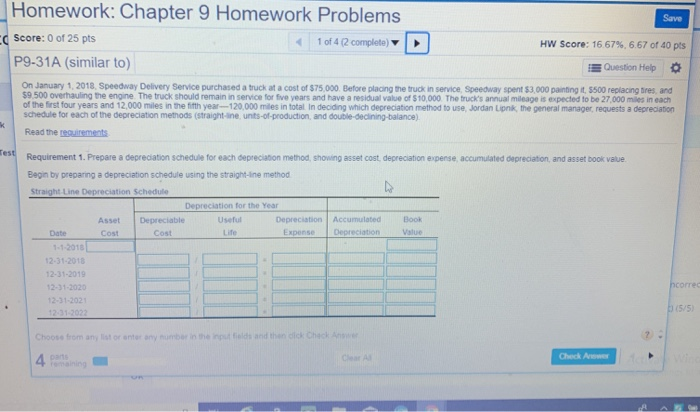

Question: Homework: Chapter 9 Homework Problems Save Score: 0 of 25 pts 1 of 4 (2 complete) HW Score: 16.67 % , 6.67 of 40 pts

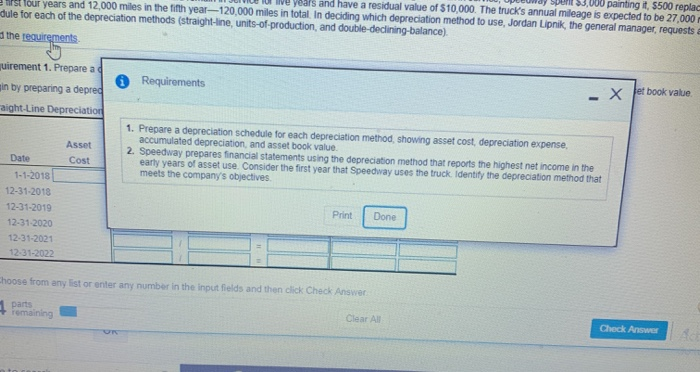

Homework: Chapter 9 Homework Problems Save Score: 0 of 25 pts 1 of 4 (2 complete) HW Score: 16.67 % , 6.67 of 40 pts P9-31A (similar to) EQuestion Help On January 1, 2018, Speedway Delivery Service purchased a truck at a cost of $75.000 Before placing the truck in service, Speedway spent $3,000 painting it, $500 replacing tres, and $9.500 overhauling the engine The truck should remain in service for five years and have a residual value of $10,000 The truck's annual mileage is expected to be 27,.000 miles in each of the first four years and 12,000 miles in the fifth year-120,000 miles in total In deciding which depreciation method to use, Jordan Lipnk, the general manager, requests aa depreciation schedule for each of the depreciation methods (straight-ine, unts-of-production, and double-declining-balance) Read the requirements Test Requirement 1. Prepare a depreciation schedule for each depreciation method, showing asset cost depreciation expense, accumulated depreciation, and asset book value Begin by preparing a depreciation schedule using the straight-ine method Straight Line Depreciation Schedule Depreciation for the Year Depreciable Depreciation Accumulated Book Asset Useful Depreciation Value Expense Date Cost Cost Life 1-1-2018 12-31-2018 12-31-2019 hcorrec 12-31-2020 12-31-2021 b (5/5) 12-31-2022 Choose from any list or enter any number in the inputfields and then dick Chack Answe Check Arewe 4 parts remaining Clear A ent s3,000 painting it, $500 replac u years and have a residual value of $10,000. The truck's annual mleage is expected to be 27,000 m SE Tour years and 12,000 miles in the fifth year-120,000 miles in total. In deciding which depreciation method to use, Jordan Lipnik, the general manager, requests dule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance) 1 the requirements uirement 1. Prepare a d et book value X Requirements in by preparing a depred aight-Line Depreciation 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense accumulated depreciation, and asset book value 2. Speedway prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Speedway uses the truck Identify the depreciation method that meets the company's objectives Asset Date Cost 1-1-2018 12-31-2018 Print Done 12-31-2019 12-31-2020 12-31-2021 12-31-2022 Choose from any list or enter any number in the input fields and then click Check Answer 1 parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts