Question: = Homework: Chapter 9 Homework Question 2, P9-3 (similar ... Part 1 of 4 HW Score: 55.56%, 3.33 of 6 points O Points: 0 of

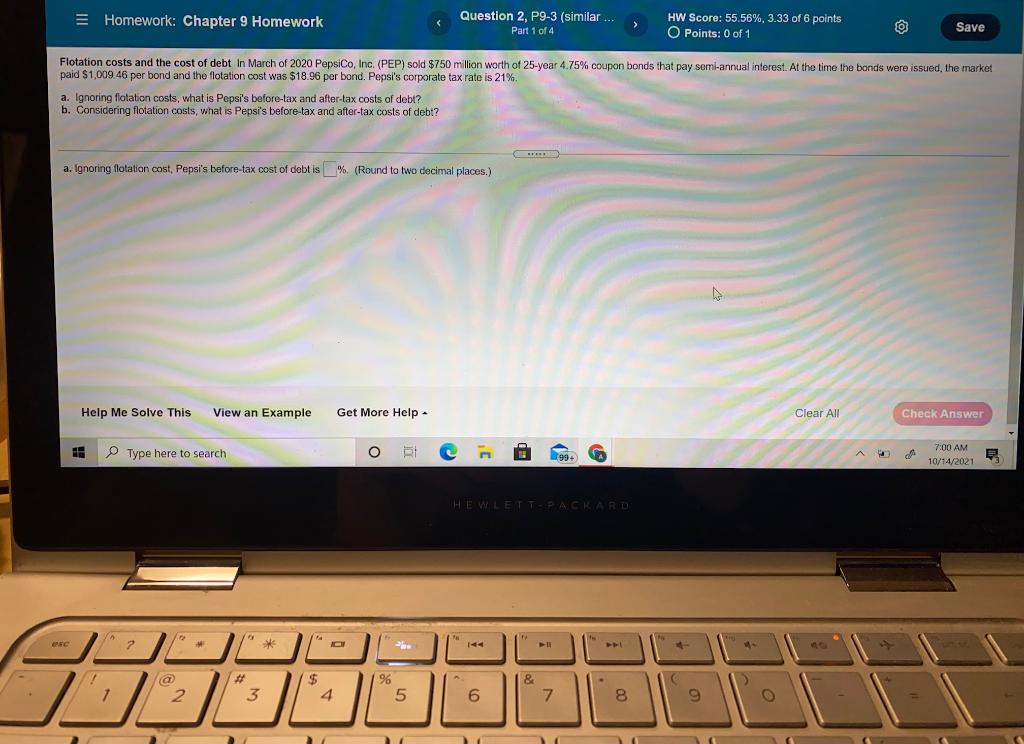

= Homework: Chapter 9 Homework Question 2, P9-3 (similar ... Part 1 of 4 HW Score: 55.56%, 3.33 of 6 points O Points: 0 of 1 O Save Flotation costs and the cost of debt in March of 2020 PepsiCo, Inc. (PEP) sold $750 million worth of 25-year 4.75% coupon bonds that pay semi-annual interest. At the time the bonds were issued the market , --, paid $1,009.46 per bond and the flotation cost was $18.96 per bond. Pepsi's corporate tax rate is 21%. a. Ignoring flotation costs, what is Pepsi's before-tax and after-tax costs of debt? b. Considering flotation costs, what is Pepsi's before tax and after-tax costs of debt? a. Ignoring tlatation cost, Pepsi's before-tax cost of debt is % (Round to two decimal places.) Help Me Solve This View an Example Get More Help Clear All Check Answer H Type here to search O O Bit C A 99+ 7:00 AM 10/14/2021 HEWLETT-PACKARD EC 2 * - $ 4 % 5 & 7 1 3 2 6 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts