Question: = Homework: Chapter 9 Homework Question 8, P9-13 (simil... Part 1 of 2 HW Score: 0%, 0 of 11 points O Points: 0 of 1

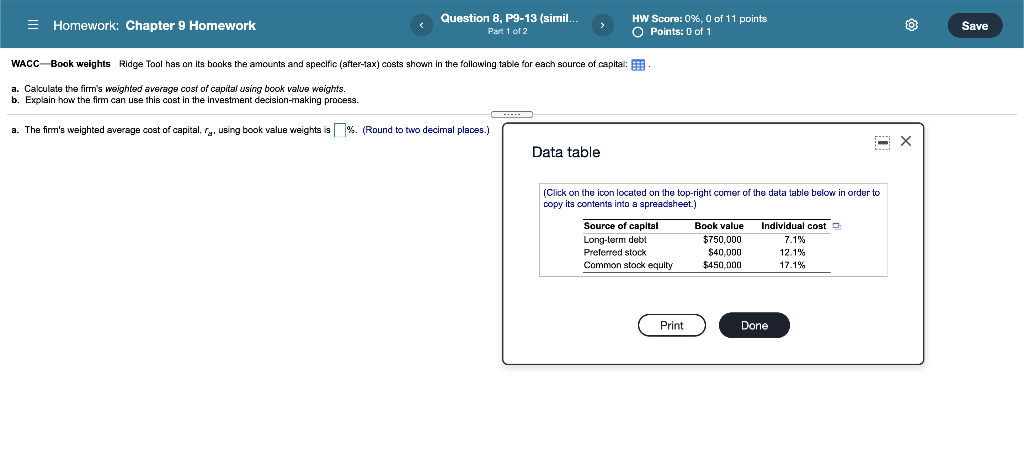

= Homework: Chapter 9 Homework Question 8, P9-13 (simil... Part 1 of 2 HW Score: 0%, 0 of 11 points O Points: 0 of 1 Save WACC-Book weights Ridge Tool has on its books the amounts and specific (after-tax) costs shown in the following table for each source of capital: 0 a. Calculate the firm's weighted average cost of capital using book valve weights. b. Explain how the firm can use this cost in the investment decision-making process. a. The firm's weighted average cost of capital.ly, using book value weights is%. (Round to two decimal places.) Data table (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Source of capital Book value Individual cost Long-term debi $750,000 7.1% Preferred stock $40.000 12.1% Common stock equity $450,000 17.1% Print Done = Homework: Chapter 9 Homework Question 8, P9-13 (simil... Part 1 of 2 HW Score: 0%, 0 of 11 points O Points: 0 of 1 Save WACC-Book weights Ridge Tool has on its books the amounts and specific (after-tax) costs shown in the following table for each source of capital: 0 a. Calculate the firm's weighted average cost of capital using book valve weights. b. Explain how the firm can use this cost in the investment decision-making process. DISED a. The firm's weighted average cost of capital, ty, using book value weights is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts