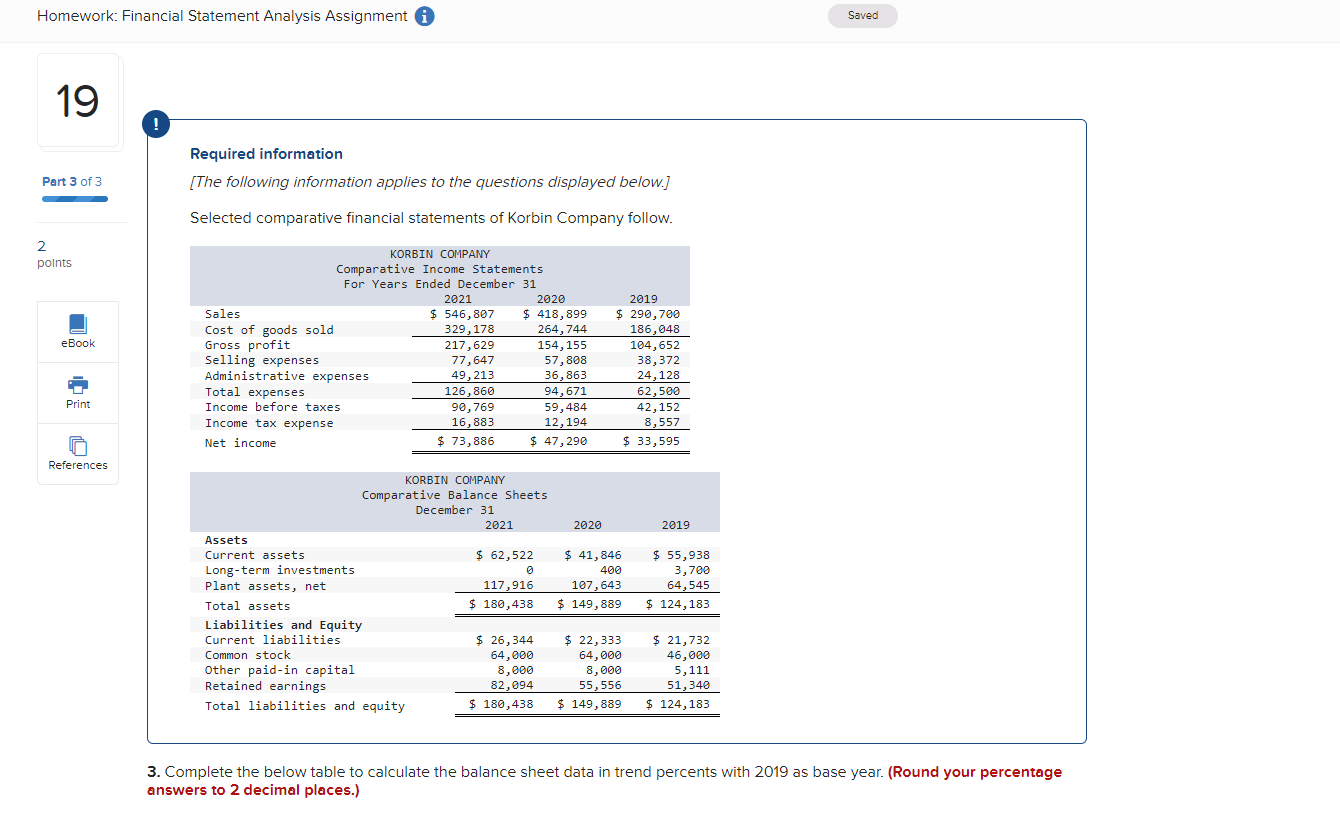

Question: Homework: Financial Statement Analysis Assignment i Saved 19 Required information Part 3 of 3 [The following information applies to the questions displayed below.] Selected comparative

![3 of 3 [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f68bcaf2373_67466f68bcae0811.jpg)

Homework: Financial Statement Analysis Assignment i Saved 19 Required information Part 3 of 3 [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. 2 KORBIN COMPANY points Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales $ 546, 807 $ 418, 899 $ 290, 700 cost of goods sold 329, 178 264, 744 186, 048 Book Gross profit 217, 629 154, 155 104, 652 Selling expenses 77, 647 57, 808 38, 372 Administrative expenses 49, 213 36, 863 24, 128 Total expenses 126, 860 94, 671 62,500 Print Income before taxes 90, 769 59, 484 42, 152 Income tax expense 16, 883 12, 194 8,557 Net income $ 73, 886 $ 47, 290 $ 33, 595 References KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 2019 Assets Current assets $ 62,522 $ 41, 846 $ 55,938 Long-term investments 400 3,700 Plant assets, net 117, 916 107, 643 4, 545 Total assets $ 180, 438 $ 149, 889 $ 124, 183 Liabilities and Equity Current liabilities $ 26,344 $ 22,333 $ 21, 732 Common stock 64, 000 64, 006 46,000 Other paid-in capital 8,000 8, 090 5, 111 Retained earnings 82, 094 55,556 51, 340 Total liabilities and equity $ 180, 438 $ 149, 889 $ 124, 183 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as base year. (Round your percentage answers to 2 decimal places.)3. Complete the below table to calculate the bala nce sheet data in trend percents with 2019 as base year. {Round your percentage answers 1.0 2 decimal places.) Assets Current assets Longtenn investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paidin capital Retained eamings Total liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts