Question: Homework Help: Hello, need help answering the attached exercises related to partnership. Please provide solutions and detailed explanations. Exercise 4-4.7 On December 31, 2019 the

Homework Help:

Hello, need help answering the attached exercises related to partnership. Please provide solutions and detailed explanations.

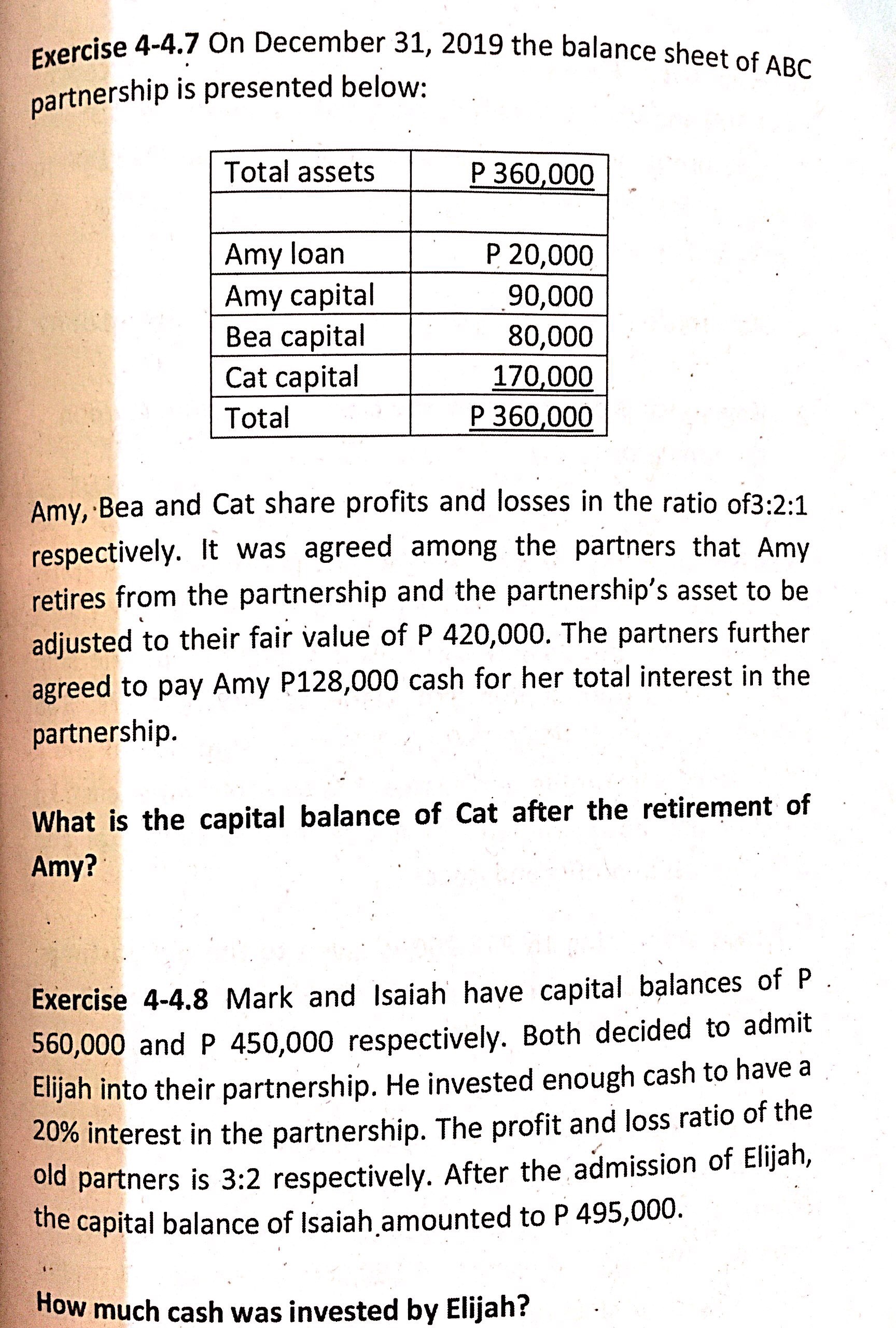

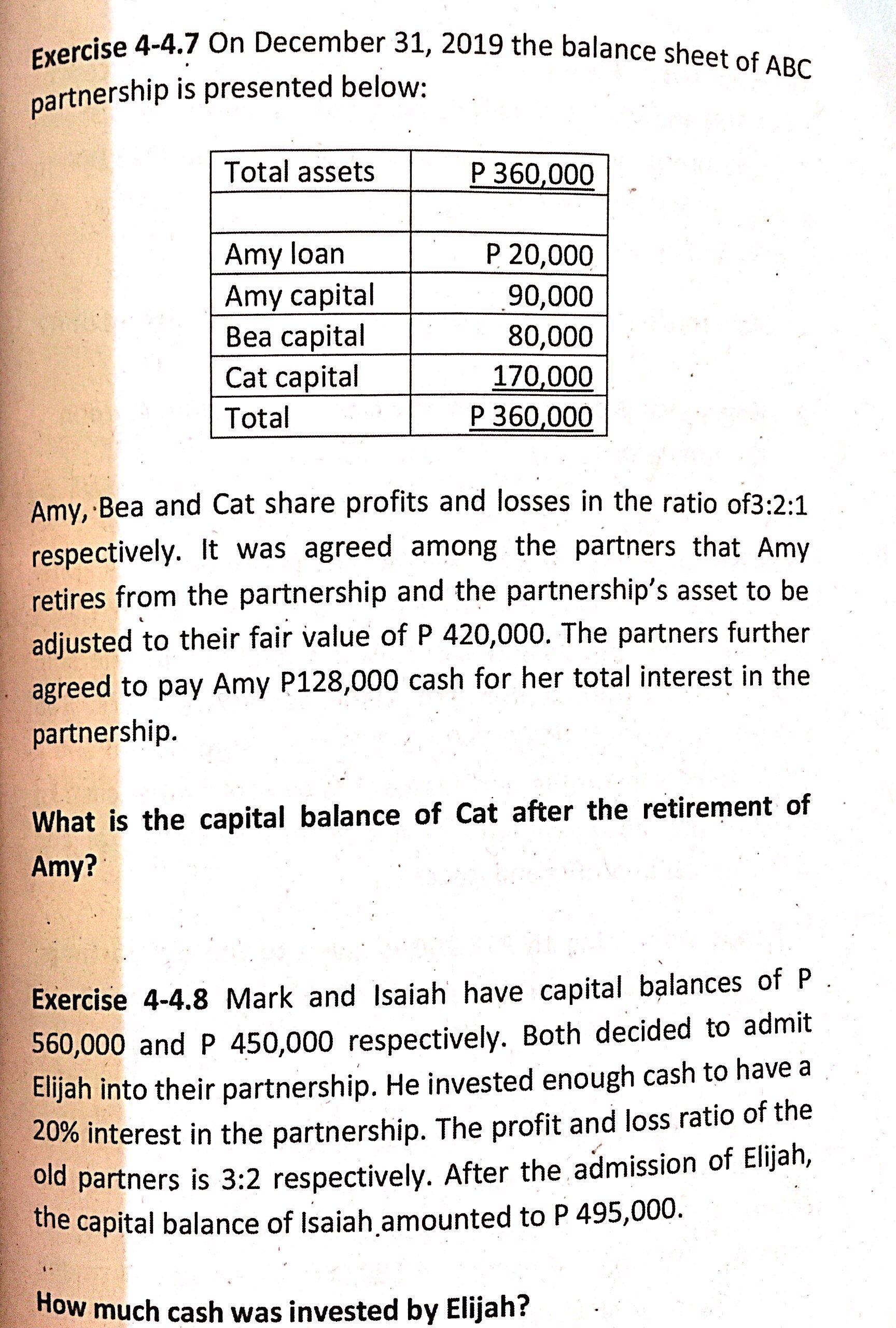

Exercise 4-4.7 On December 31, 2019 the balance sheet of ABC partnership is presented below: Total assets Amy loan Amy capital Bea capital Cat capital Total P 360,000 P 20,000 90,000 80,000 170 ooo P 360 OOO Amy, Bea and Cat share profits and losses in the ratio of3:2:1 respectively. It was agreed among the partners that Amy retires from the partnership and the partnership's asset to be adjusted to their fair value of P 420,000. The partners further agreed to pay Amy P128,000 cash for her total interest in the partnership. What is the capital balance of Cat after the retirement of Amy? Exercise 4-4.8 Mark and Isaiah have capital balances of P 560,000 and P 450,000 respectively. Both decided to admit Elijah into their partnership. He invested enough cash to have a 20% interest in the partnership. The profit and loss ratio of the Old partners is 3:2 respectively. After the admission of Elijah, the capital balance of Isaiah.amounted to P 495,000. How much cash was invested by Elijah?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts