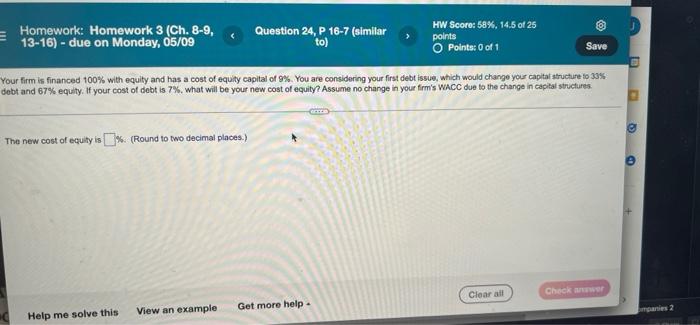

Question: = Homework: Homework 3 (Ch. 8-9, 13-16) - due on Monday, 05/09 Question 24, P 16-7 (similar to) HW Score: 58% 14.5 of 25 points

= Homework: Homework 3 (Ch. 8-9, 13-16) - due on Monday, 05/09 Question 24, P 16-7 (similar to) HW Score: 58% 14.5 of 25 points Points: 0 of 1 Save Your firm is financed 100% with equity and has a cost of equity capital of 9%. You are considering your first debt issue, which would change your capital structure to 33% debt and 67% equity. If your cost of debt is 7%, what will be your new cost of equity? Assume no change in your firm's WACC due to the change in capital structures The new cost of equity is % (Round to two decimal places.) e Clear all Checker View an example Get more help Help me solve this ugnies 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts