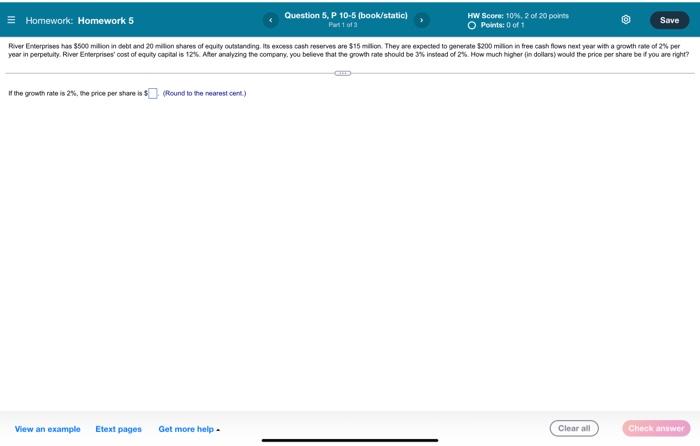

Question: = Homework: Homework 5 Question 5, P 10-5 (book/static) HW Score: 10%. 7 of 20 points Save Part1013 O Points of 1 Rover Enterprises has

= Homework: Homework 5 Question 5, P 10-5 (book/static) HW Score: 10%. 7 of 20 points Save Part1013 O Points of 1 Rover Enterprises has 500 million in debt and 20 million shares of equity outstanding. Its excess cash reserves are $15 million. They are expected to generate $200 million in free cash flows next year with a growth rate of 2% per year in perpetuity River Enterprises cost of equity capital is 12%. After analyzing the company, you believe that the growth rate should be 34 instead of 2%. How much higher in dollars) would the price per share bell you are right? If the growth rate is 2%. the price per share around to the nearest cent) View an example Etext pages Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts