Question: = Homework: Homework Set 2 Question 23, P7-5 (simila... Part 1 of 3 HW Score: 20.18%, 10.09 of 50 points O Points: 0 of 2

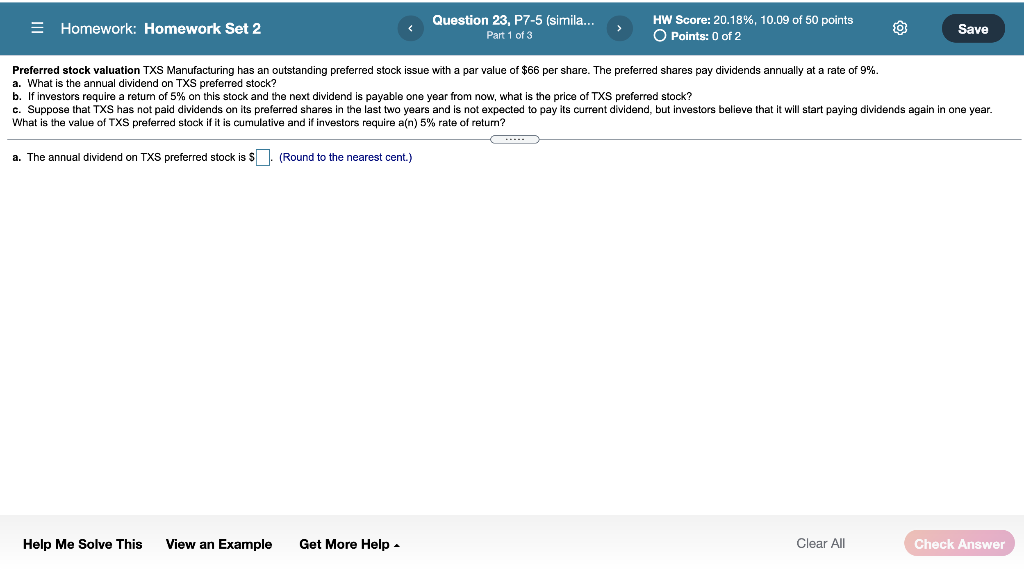

= Homework: Homework Set 2 Question 23, P7-5 (simila... Part 1 of 3 HW Score: 20.18%, 10.09 of 50 points O Points: 0 of 2 O Save Preferred stock valuation TXS Manufacturing has an outstanding preferred stock issue with a par value of $66 per share. The preferred shares pay dividends annually at a rate of 9%. a. What is the annual dividend on TXS preferred stock? b. If investors require a retum of 5% on this stock and the next dividend is payable one year from now, what is the price of TXS preferred stock? C. Suppose that TXS has not paid dividends on its preferred shares in the last two years and is not expected to pay its current dividend, but investors believe that it will start paying dividends again in one year. What is the value of TXS preferred stock if it is cumulative and if investors require a(n) 5% rate of return? .... a. The annual dividend on TXS preferred stock is $(Round to the nearest cent.) Help Me Solve This View an Example Get More Help Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts