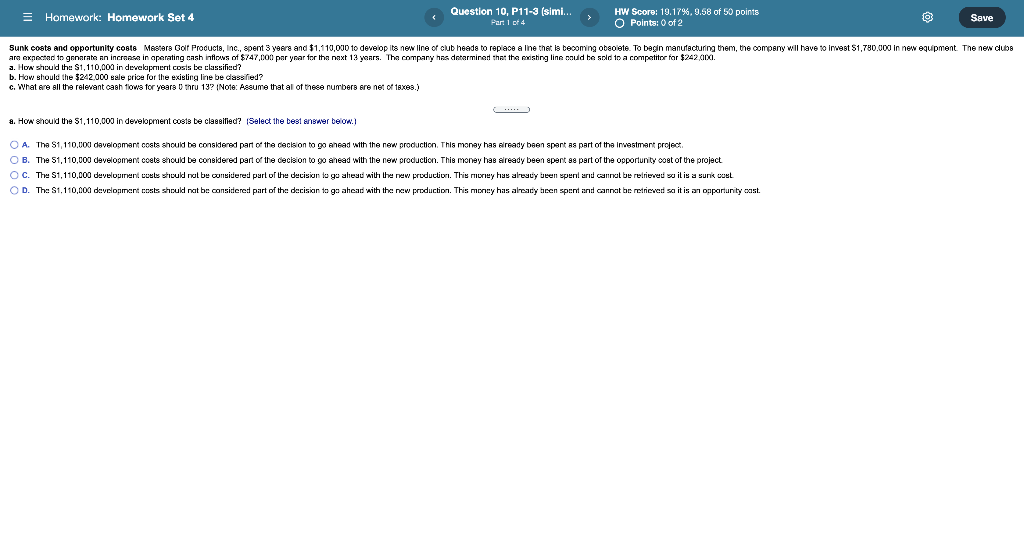

Question: = Homework: Homework Set 4 Question 10, P11-3 (simi.. HW Score: 19.17%, 9.58 of 50 points Pari 14 Points: 0 of 2 Save Sun poster

= Homework: Homework Set 4 Question 10, P11-3 (simi.. HW Score: 19.17%, 9.58 of 50 points Pari 14 Points: 0 of 2 Save Sun poster and opportunity.cools Merengue e na a na them, the company will have to Invest 81,780.000 in new equipment. The new clube in operating cash infoss of $747,000 per year ou par year for the next 18 years. The company has detarmined that the parishing line nud ha sold to a competitor for for $242 ata . a. How should the S1,110,000 in devekprent costs be classified? b. How should the $242.000 sale price for the existing line be classified? c. What are all the relevant cash flows for years thru 13? Note: Assume that al of these numbers are net of 18xes.) a. How should the $1,110,000 in development costs be classified? (Select the best answer below: O A. The S1, 110.000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the Investment project OB. The 51,110,000 development coets should be considered part of the decision to go ahead with the new production. This money has already been spent a part of the opportunity cost of the project OC. The S1, 110,000 developinvent costs should not be considered part of the decision to go ahead with the new production. This money has already been spent and cannot be retrieved so it is a sunk cust OD. The S1,110,000 devcoament costs should not be considered part of the decision to go ahead with the new production. This money has alcacy ocen spent cannat be retrieved so it is an opportunity cast. = Homework: Homework Set 4 Question 10, P11-3 (simi.. HW Score: 19.17%, 9.58 of 50 points Pari 14 Points: 0 of 2 Save Sun poster and opportunity.cools Merengue e na a na them, the company will have to Invest 81,780.000 in new equipment. The new clube in operating cash infoss of $747,000 per year ou par year for the next 18 years. The company has detarmined that the parishing line nud ha sold to a competitor for for $242 ata . a. How should the S1,110,000 in devekprent costs be classified? b. How should the $242.000 sale price for the existing line be classified? c. What are all the relevant cash flows for years thru 13? Note: Assume that al of these numbers are net of 18xes.) a. How should the $1,110,000 in development costs be classified? (Select the best answer below: O A. The S1, 110.000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the Investment project OB. The 51,110,000 development coets should be considered part of the decision to go ahead with the new production. This money has already been spent a part of the opportunity cost of the project OC. The S1, 110,000 developinvent costs should not be considered part of the decision to go ahead with the new production. This money has already been spent and cannot be retrieved so it is a sunk cust OD. The S1,110,000 devcoament costs should not be considered part of the decision to go ahead with the new production. This money has alcacy ocen spent cannat be retrieved so it is an opportunity cast

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts