Question: Homework: Homework Set 4 Question 17, P11-24 (si... Part 1 of 10 HW Score: 19.17%, 9.58 of 50 points Points: 0 of 2 Save Risk-adjusted

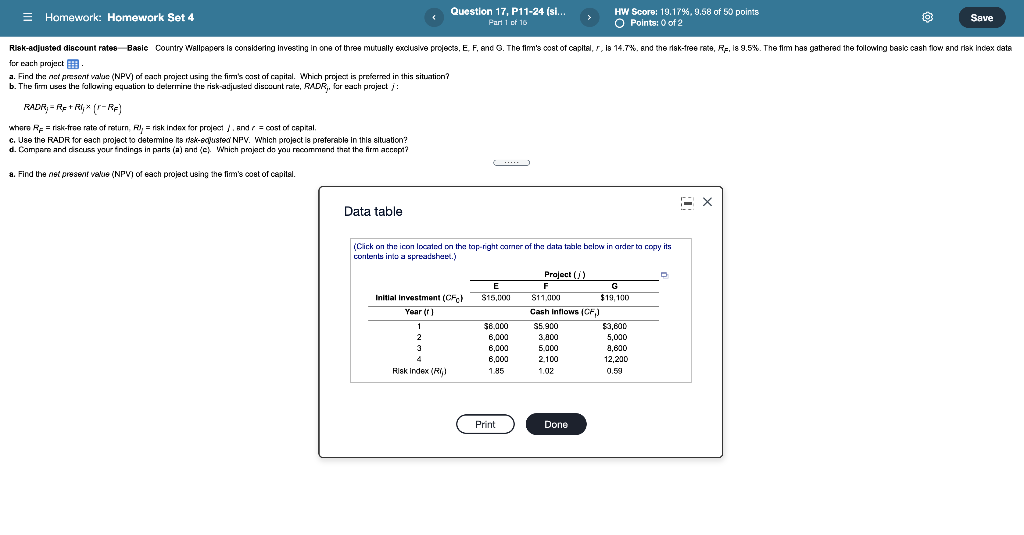

Homework: Homework Set 4 Question 17, P11-24 (si... Part 1 of 10 HW Score: 19.17%, 9.58 of 50 points Points: 0 of 2 Save Risk-adjusted discount rates Basic Country Wallpapera la considering Investing in one of three mutually exclusive projects, E, F, and G. The film's coat of capitel, T. i8 14.7%. and the mak-free rete, RE, 18 9.5%. The firm has gathered the following basic cash flow and risk incex cats for each project a. Find the not present value (NPV) of each project using the firm's cast of capital. Which project is prrcred in this situation? b. The im uses the following equation to determine the risk-adjusted discount rate, RADR, for each project : RADR-RE+R, ir-RF) whara R = risk-free rate at return, R), = nisk index for project and r = cost of capral c. Use the RADR for each project to detemine tartekogusted NPV. Which project is preferable in this situation? d. Compare and discuss your findings in parts (a) and ( Which project do you recommend that the firm accept? 8. Find the nel present valis (NPVI of each project using the fim's cost of capital. - X Data table (Click on the icon Incated on the top-right corner of the data trahle below in arder la copy its contents into a spreadshe.) E $15.000 Initial investment (CF) Year) 1 2 3 4 Risk Index (R4) $6.000 6,000 6,000 6,000 1.85 Project) F G S11.00 $19,100 Cash inflows (CF) S5.900 $3,600 3.800 5,000 5.000 8,800 2.100 12,200 1.02 0.59 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts