Question: Homework: HW #10: Taxes & Depreciation Question 2, Problem 9-29 (book/static) Part 1 of 8 HW Score: 0%, 0 of 80 points Points: 0 of

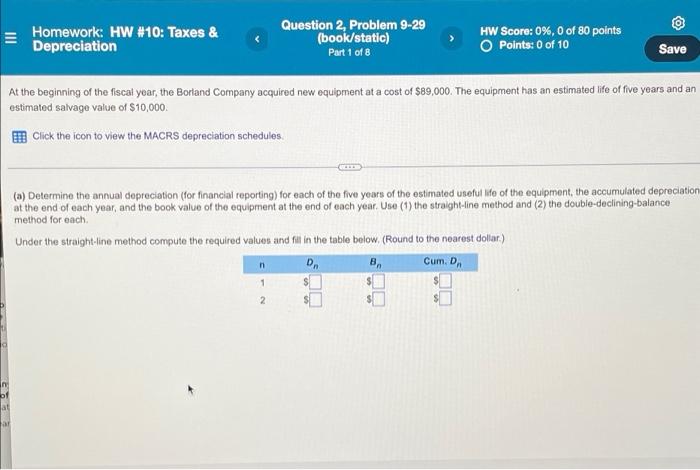

Homework: HW #10: Taxes & Depreciation Question 2, Problem 9-29 (book/static) Part 1 of 8 HW Score: 0%, 0 of 80 points Points: 0 of 10 Save At the beginning of the fiscal year, the Borland Company acquired new equipment at a cost of $89,000. The equipment has an estimated life of five years and an estimated salvage value of $10,000 Click the icon to view the MACRS depreciation schedules (a) Determine the annual depreciation (for financial reporting) for each of the five years of the estimated useful life of the equipment, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year. Use (1) the straight-line method and (2) the double-declining-balance method for each Under the straight-line method compute the required values and fill in the table below. (Round to the nearest dollar) Cum D n 1 2 n of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts