Question: = Homework: HW #3 - Chapter 11 Question 5, P11-15 (similar to) > HW Score: 60%, 3 of 5 points O Points: 0 of 1

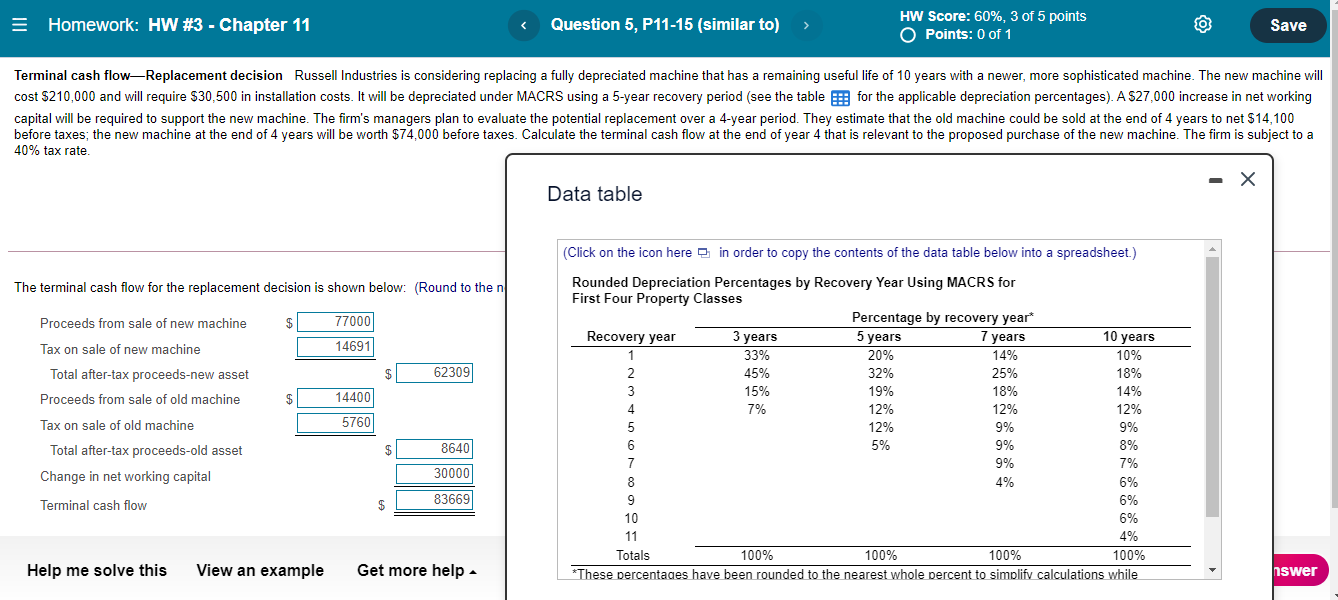

= Homework: HW #3 - Chapter 11 Question 5, P11-15 (similar to) > HW Score: 60%, 3 of 5 points O Points: 0 of 1 Save Terminal cash flow-Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $210,000 and will require $30,500 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table for the applicable depreciation percentages). A $27,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $14,100 before taxes, the new machine at the end of 4 years will be worth $74,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% tax rate. - X Data table - The terminal cash flow for the replacement decision is shown below: (Round to the n Proceeds from sale of new machine $ 77000 14691 $ 62309 $ 14400 Tax on sale of new machine Total after-tax proceeds-new asset Proceeds from sale of old machine Tax on sale of old machine Total after-tax proceeds-old asset Change in net working capital (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 9 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while 5760 $ 9 8640 30000 Terminal cash flow 83669 $ Help me solve this View an example Get more help nswer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts