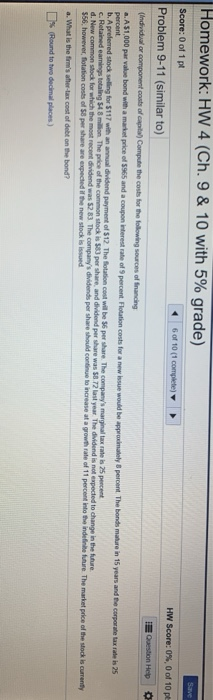

Question: Homework: HW 4 (Ch. 9 & 10 with 5% grade) Score: 0 of 1 pt 6 of 10 (1 complete Problem 9-11 (similar to) HW

Homework: HW 4 (Ch. 9 & 10 with 5% grade) Score: 0 of 1 pt 6 of 10 (1 complete Problem 9-11 (similar to) HW Score: 0% 0 of 10 pe Question Help (Individual or component costs of capital Compute the costs for the following sources of financing a. A 31,000 par le bond with a market price of $965 and a coupon interest rate of 9 percent Flotation costs for a new issue would be approximately percent The bonds mature in 15 years and the corporate tax rates 25 percent b. A preferred stock seling for $117 with an annual dividend payment of $12 The Rotation cost wil be $6 per share. The company's marginal tax rate 25 percent c. Retained earings totaling 48 million The price of the common stock is per share and dividend per share was 1872 last year The dividend is not expected to change in the Nure. d. New common stock for which the most recent dividend was $283. The company's dividends per share should continue to increase at a growth rate of 11 percent into the indefinite future the market price of the stock is currently $56, however, flotation costs of Sper share are expected the new stock issued a. What is the firm's after-tax cost of debt on the bond? % (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts