Question: = Homework: Lab 04 = Question 1, Problem 7-1 (algorithmic) HW Score: 6.67%, 1 of 15 points O Points: 0 of 1 0 Save Part

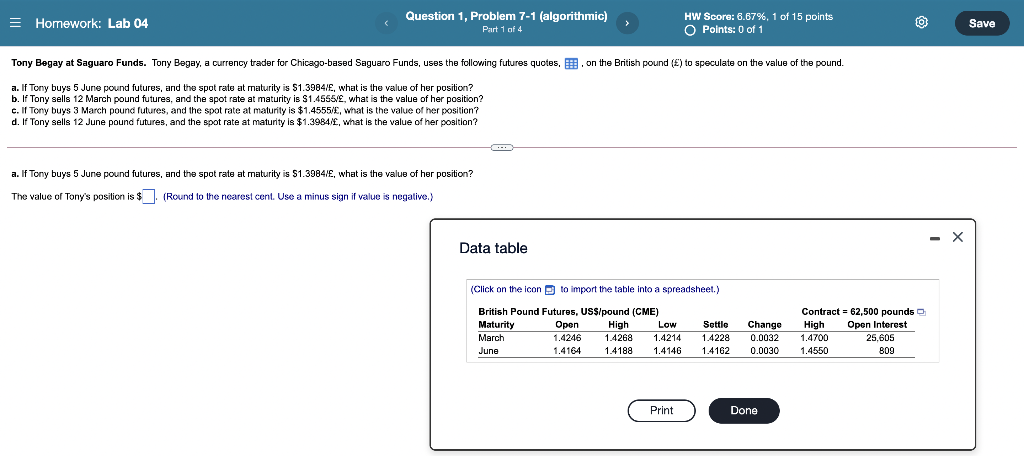

= Homework: Lab 04 = Question 1, Problem 7-1 (algorithmic) HW Score: 6.67%, 1 of 15 points O Points: 0 of 1 0 Save Part 1 of 4 Tony Begay at Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses the following futures quotes, B. on the British pound () to speculate on the value of the pound. a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3984/, what is the value of her position? b. If Tony sells 12 March pound futures, and the spot rate at maturity is $1.4555/, what is the value of her position? c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.4555/, what is the value of her position? d. If Tony sells 12 June pound futures, and the spot rate at maturity is $1.3984/, what is the value of her position? a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3984/, what is the value of her position? The value of Tony's position is $(Round to the nearest cent. Use a minus sign if value is negative. $ () - X Data table (Click on the icon to import the table into a spreadsheet.) British Pound Futures, USS/pound (CME) Maturity Open High Low March 1.4268 1.4214 June 1.4164 1.4188 1.4146 Settle 1.4228 1.4162 1.4246 Contract = 62,500 pounds High Open Interest 1.4700 25.605 1.4550 809 Change 0.0032 0.0030 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts