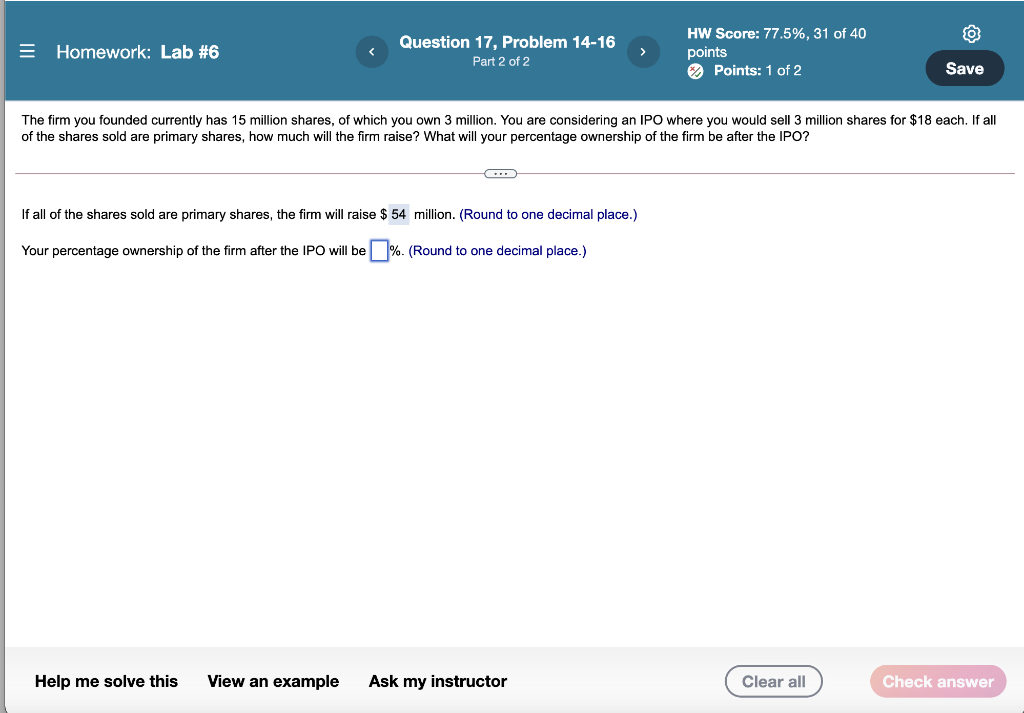

Question: = Homework: Lab #6 Question 17, Problem 14-16 Part 2 of 2 > HW Score: 77.5%, 31 of 40 points Points: 1 of 2 Save

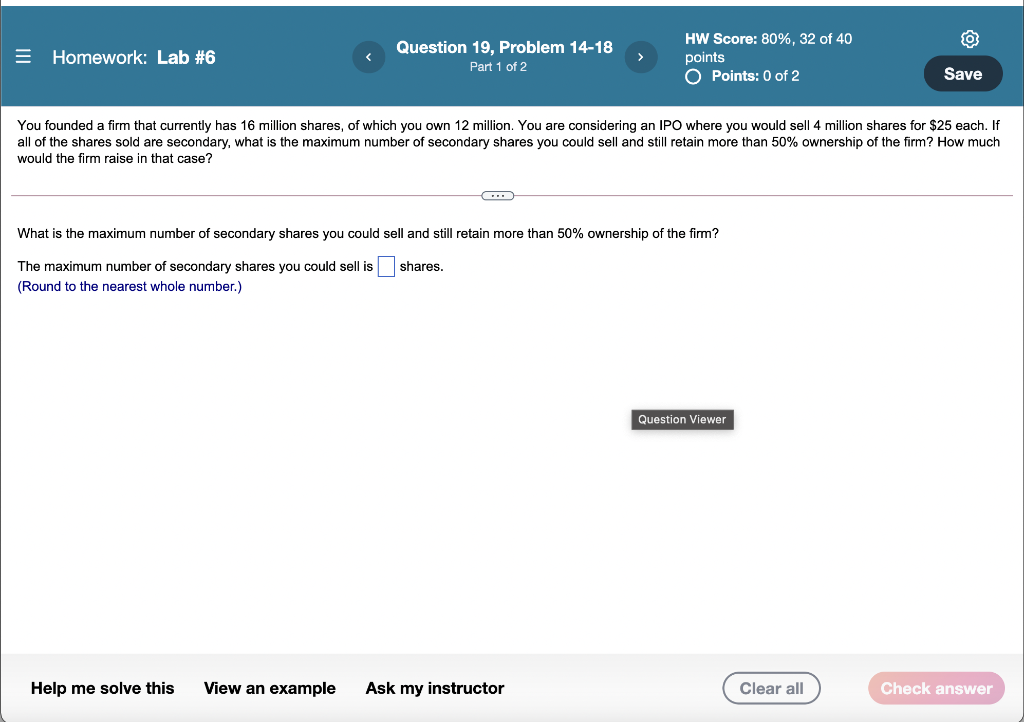

= Homework: Lab #6 Question 17, Problem 14-16 Part 2 of 2 > HW Score: 77.5%, 31 of 40 points Points: 1 of 2 Save The firm you founded currently has 15 million shares, of which you own 3 million. You are considering an IPO where you would sell 3 million shares for $18 each. If all of the shares sold are primary shares, how much will the firm raise? What will your percentage ownership of the firm be after the IPO? If all of the shares sold are primary shares, the firm will raise $ 54 million. (Round to one decimal place.) Your percentage ownership of the firm after the IPO will be %. (Round to one decimal place.) Help me solve this View an example Ask my instructor Clear all Check answer = Homework: Lab #6 Question 19, Problem 14-18 Part 1 of 2 HW Score: 80%, 32 of 40 points O Points: 0 of 2 Save You founded a firm that currently has 16 million shares, of which you own 12 million. You are considering an IPO where you would sell 4 million shares for $25 each. If all of the shares sold are secondary, what is the maximum number of secondary shares you could sell and still retain more than 50% ownership of the firm? How much would the firm raise in that case? What is the maximum number of secondary shares you could sell and still retain more than 50% ownership of the firm? shares. The maximum number of secondary shares you could sell is (Round to the nearest whole number.) Question Viewer Help me solve this View an example Ask my instructor Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts