Question: = Homework: Lab #9 Question 4, Problem 24-1 Part 1 of 4 HW Score: 55.26%, 21 of 38 points O Points: 0 of 8 Save

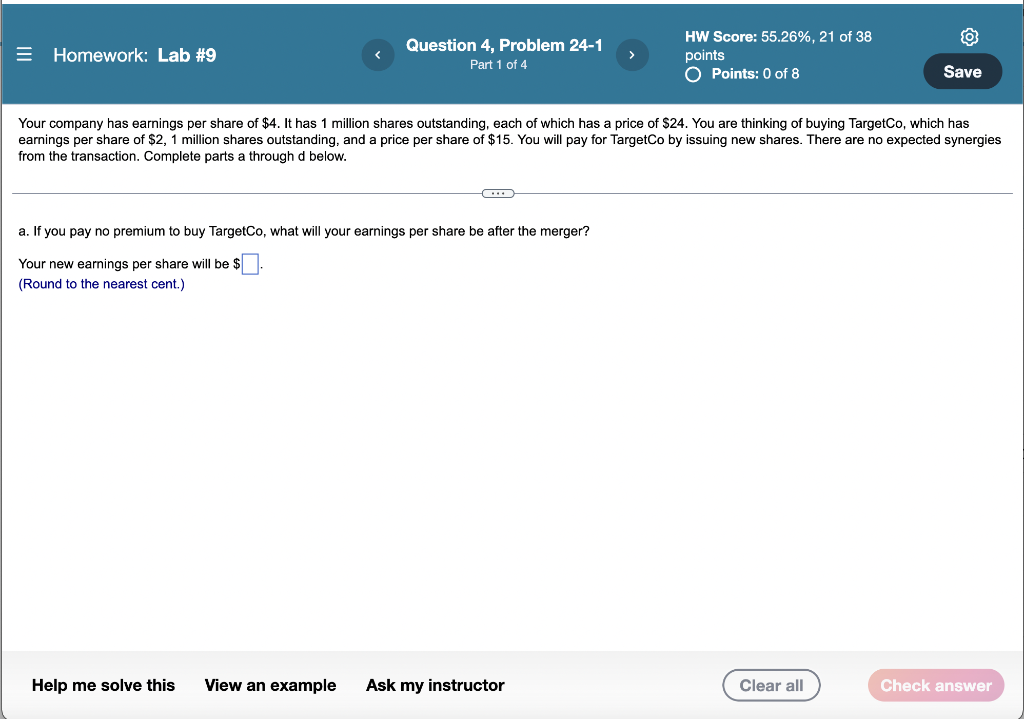

= Homework: Lab #9 Question 4, Problem 24-1 Part 1 of 4 HW Score: 55.26%, 21 of 38 points O Points: 0 of 8 Save Your company has earnings per share of $4. It has 1 million shares outstanding, each of which has a price of $24. You are thinking of buying TargetCo, which has earnings per share of $2,1 million shares outstanding, and a price per share of $15. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. Complete parts a through d below. C. a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? Your new earnings per share will be $ (Round to the nearest cent.) Help me solve this View an example Ask my instructor Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts