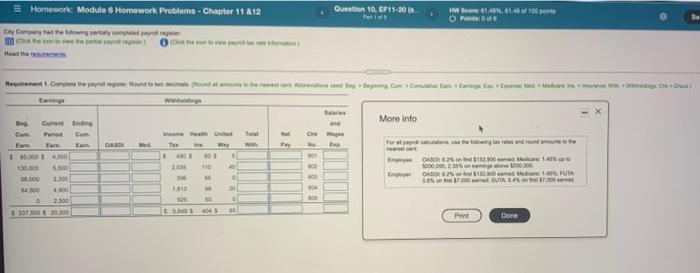

Question: Homework: Module 6 Homework Problema. Chapter 11812 Question 10, EF 11-20 HAN,1.48100 OP 6 Oy Company ha estat view Megrenam.Compowerment tout le moshes Center Merwe

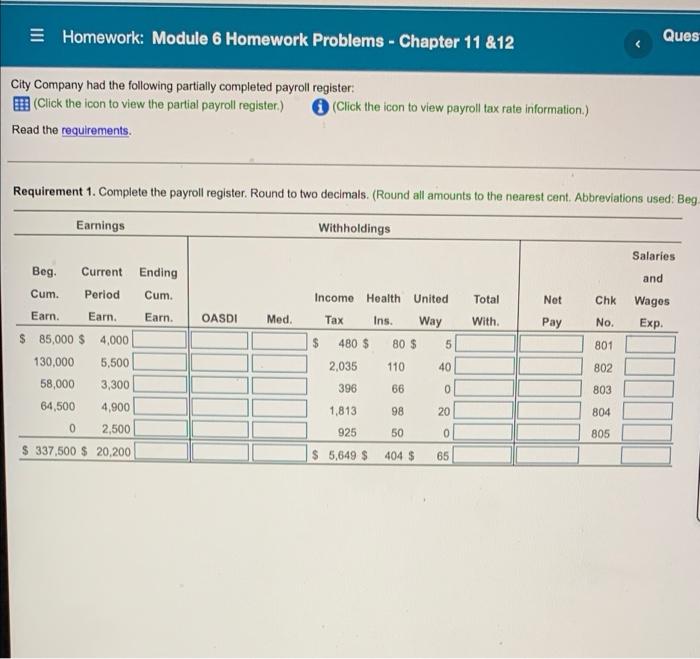

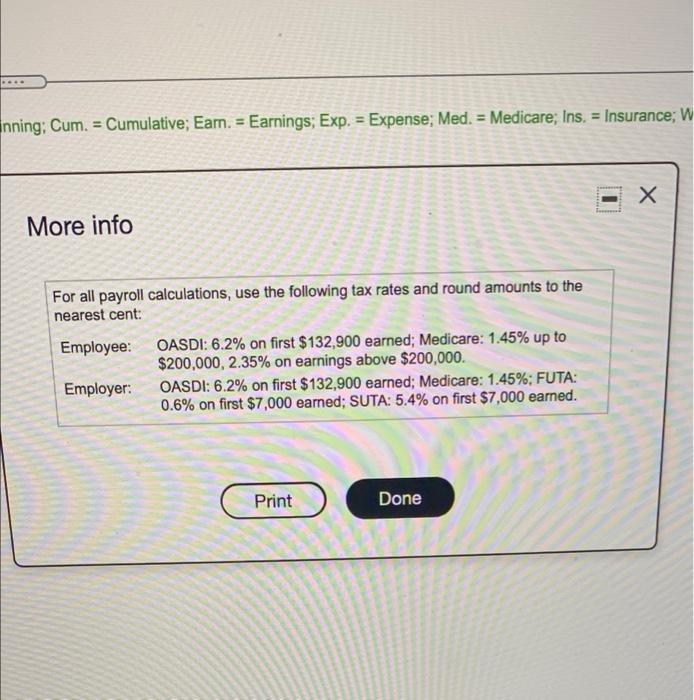

Homework: Module 6 Homework Problema. Chapter 11812 Question 10, EF 11-20 HAN,1.48100 OP 6 Oy Company ha estat view Megrenam.Compowerment tout le moshes Center Merwe wangu X More info DAD M w www 41 5 Current C Em 13.000 4.000 10 1300 Mod 600 D 2.500 1 157300129 300 DAN 2010 209.06 ABOXES 2014 FUIA . 20 S55 Print Dane Homework: Module 6 Homework Problems - Chapter 11 & 12 Ques City Company had the following partially completed payroll register: Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg Earnings Withholdings Ending Salaries and Cum. Total Net Chk Earn OASDI Wagos Exp. Med. With Pay No. Income Health United Tax Ins. Way $ 480 $ 80 $ 5 2,035 110 40 396 66 0 ch Beg. Current Cum. Period Earn Earn. $ 85,000 $ 4.000 130,000 5,500 58,000 3,300 64,500 4,900 0 2,500 $ 337,500 $ 20,200 801 802 803 1,813 98 20 804 925 50 0 805 $ 5,649 $ 404 $ 65 nning; Cum. = Cumulative; Eam. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; W More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts