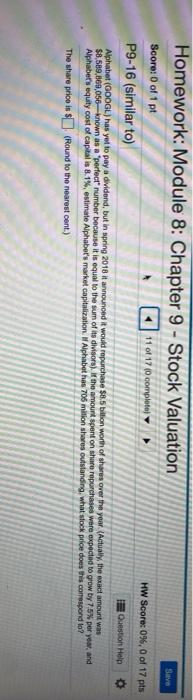

Question: Homework: Module 8: Chapter 9 - Stock Valuation Save Score: 0 of 1 pt 11 of 17 completa HW Score: 0%, 0 of 17 pts

Homework: Module 8: Chapter 9 - Stock Valuation Save Score: 0 of 1 pt 11 of 17 completa HW Score: 0%, 0 of 17 pts P9-16 (similar to) Question Help Alphabet (GOOGL) has yet to pay a dividend, but in spring 2018 it announced it would repurchase $8.5 billion worth of shares over the year. (Actually, the exact amount was $8,589,669,056-known as a 'perfect number because it is equal to the sum of its divisors). If the amount spent on share repurchases were expected to grow by 7.5% per year, and Alphabet's equity cost of capital is 8.1%, estimate Alphabet's market capitalization Alphabet has 706 million shares outstanding, what stock price does this correspond to? The share price is $(Round to the nearest cont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts