Question: Homework: Problem Set 3 Question 4, Problem 10-30 (similar to) HW Score: 2696, 14 of 50 points Part 1 of 8 O Points: 0 of

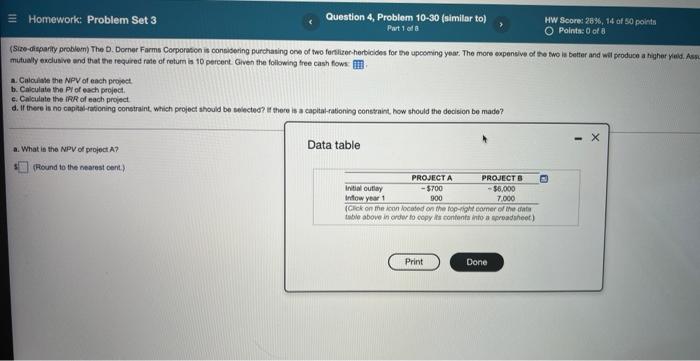

Homework: Problem Set 3 Question 4, Problem 10-30 (similar to) HW Score: 2696, 14 of 50 points Part 1 of 8 O Points: 0 of 8 (Size-disparity problem) The D. Dorner Forms Corporation is considering purchasing one of two fertilizer-herbicides for the upcoming year. The more expensive of the two is better and wil produce a higher yield. As mutuwly exclusive and that the required rate of retum is 10 percent. Given the following free cash flows: a. Calculate the NPV of each project b. Calculate the Prof each project e. Calculate the IRR of each project d. If there is no capital rationing constraint, which project should be selected? If there is a capita rationing constraint, how should the decision be made? - X a. What is the NPV of project A? Data table (Round to the nearest cont.) PROJECT A Initin outlay -$700 - $6.000 Inow year 1 900 (Grok on me on located on the top right comer of the date table above in ordw to copy its content into a poadheet) PROJECTS 7.000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts