Question: Homework Problems: 1. Mr. Salim decided to start a project in Muscat. It is estimated that he has to invest OMR 300000 and that the

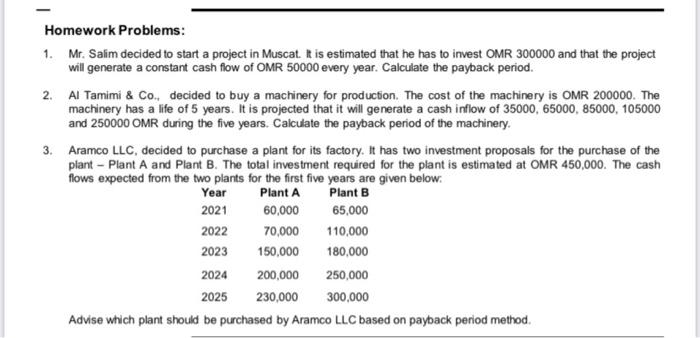

Homework Problems: 1. Mr. Salim decided to start a project in Muscat. It is estimated that he has to invest OMR 300000 and that the project will generate a constant cash flow of OMR 50000 every year. Calculate the payback period. 2. Al Tamimi & Co., decided to buy a machinery for production. The cost of the machinery is OMR 200000. The machinery has a life of 5 years. It is projected that it will generate a cash inflow of 35000, 65000, 85000, 105000 and 250000 OMR during the five years. Calculate the payback period of the machinery. 3. Aramco LLC, decided to purchase a plant for its factory. It has two investment proposals for the purchase of the plant - Plant A and Plant B. The total investment required for the plant is estimated at OMR 450,000. The cash flows expected from the two plants for the first five years are given below: Year Plant A Plant B 2021 60,000 65,000 2022 70,000 110,000 2023 150,000 180,000 2024 200,000 250,000 2025 230,000 300,000 Advise which plant should be purchased by Aramco LLC based on payback period method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts