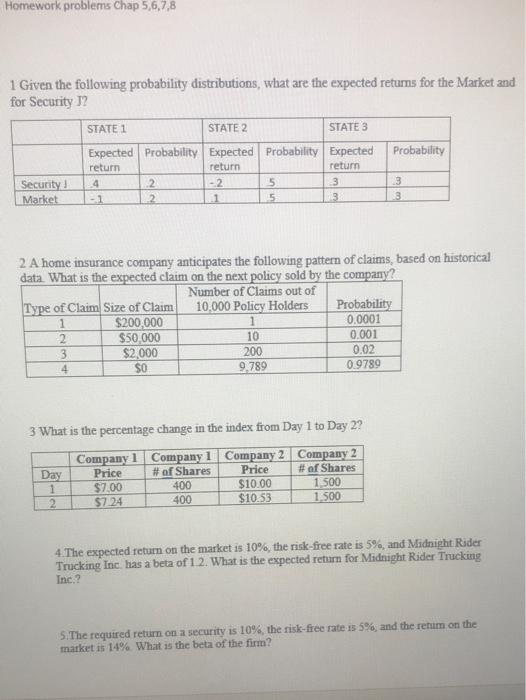

Question: Homework problems Chap 5,6,7,8 1 Given the following probability distributions, what are the expected returns for the Market and for Security ? STATE 1 STATE

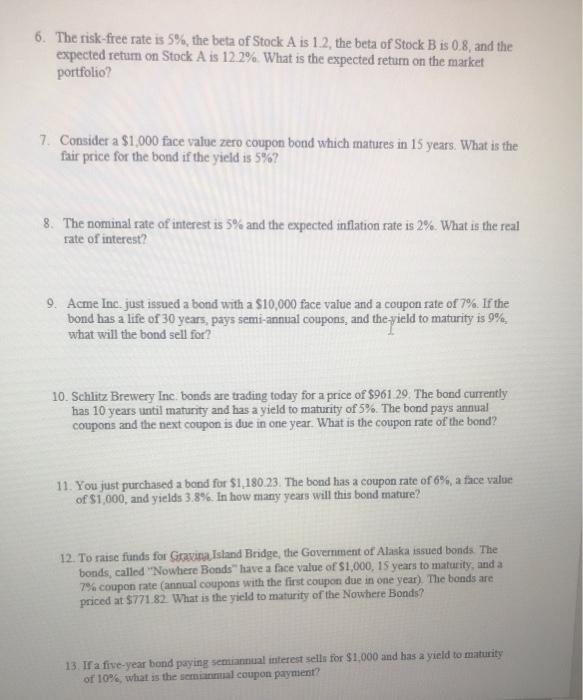

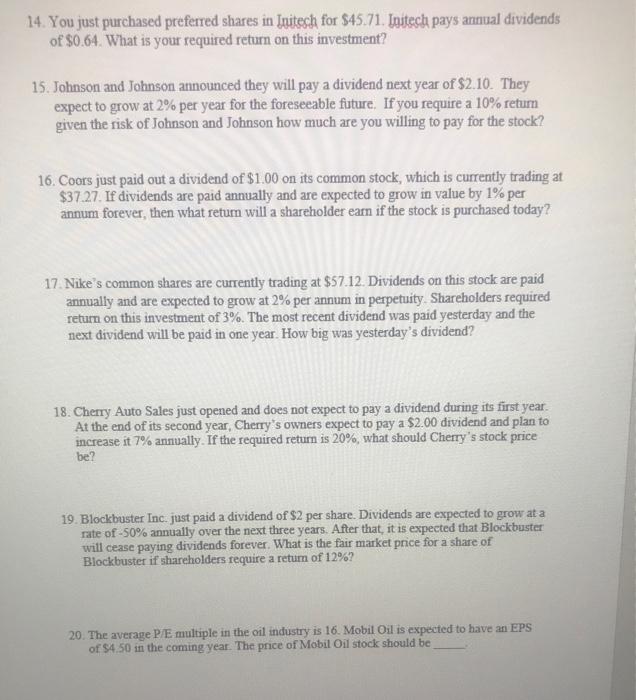

Homework problems Chap 5,6,7,8 1 Given the following probability distributions, what are the expected returns for the Market and for Security ? STATE 1 STATE 2 STATE 3 Expected Probability Expected Probability Expected Probability return return return Security 4 2 - 2 5 3 3 Market -1 2 5 13 3 2 A home insurance company anticipates the following pattern of claims, based on historical data. What is the expected claim on the next policy sold by the company? Number of Claims out of Type of Claim Size of Claim 10.000 Policy Holders Probability 1 $200,000 1 0.0001 2 $50,000 10 0.001 3 $2,000 200 0.02 4 $0 9,789 0.9789 3 What is the percentage change in the index from Day 1 to Day 2? Company 1 Company 1 Company 2 Company 2 Day Price # of Shares Price # of Shares 1 $7.00 400 $10.00 1.500 2 $724 400 $10.53 1.500 4. The expected return on the market is 10%, the risk-free rate is 5%, and Midnight Rider Trucking Inc. has a beta of 1 2. What is the expected return for Midnight Rider Trucking Inc.? 5. The required return on a security is 10%, the risk-free rate is 5%, and the retum on the market is 14% What is the beta of the firm? 6. The risk-free rate is 5%, the beta of Stock A is 1.2the beta of Stock B is 0.8, and the expected return on Stock A is 12.2%. What is the expected return on the market portfolio 7. Consider a $1.000 face value zero coupon bond which matures in 15 years. What is the fair price for the bond if the yield is 5%? 8. The nominal rate of interest is 5% and the expected inflation rate is 2%. What is the real rate of interest? 9. Acme Inc. just issued a bond with a $10,000 face value and a coupon rate of 7%. If the bond has a life of 30 years, pays semi-annual coupons, and the-yield to maturity is 9% what will the bond sell for? 10. Schlitz Brewery Inc. bonds are trading today for a price of $961 29 The bond currently has 10 years until matanty and has a yield to maturity of 5%. The bond pays annual coupons and the next coupon is due in one year. What is the coupon rate of the bond? 11. You just purchased a bond for $1,180 23. The bond has a coupon rate of 6% a face value of $1,000, and yields 3.8%. In how many years will this bond mature? 12. To raise funds for Gravina Island Bridge, the Government of Alaska issued bonds The bonds, called "Nowhere Bonds have a face value of $1,000, 15 years to maturity, and a 7% coupon rate (annual coupons with the first coupon due in one year). The bonds are priced at $771.82. What is the yield to maturity of the Nowhere Bonds? 13. If a five-year bond paying semiannual interest sells for $1,000 and has a yield to maturity of 10%, what is the serial coupon payment? 14. You just purchased preferred shares in Initech for $45.71. Initech pays annual dividends of $0.64. What is your required return on this investment? 15. Johnson and Johnson announced they will pay a dividend next year of $2.10. They expect to grow at 2% per year for the foreseeable future. If you require a 10% return given the risk of Johnson and Johnson how much are you willing to pay for the stock? 16. Coors just paid out a dividend of $1.00 on its common stock, which is currently trading at $37.27. If dividends are paid annually and are expected to grow in value by 1% per annum forever, then what retum will a shareholder earn if the stock is purchased today? 17 Nike's common shares are currently trading at $57.12. Dividends on this stock are paid annually and are expected to grow at 2% per annum in perpetuity. Shareholders required return on this investment of 3%. The most recent dividend was paid yesterday and the next dividend will be paid in one year. How big was yesterday's dividend? 18. Cherry Auto Sales just opened and does not expect to pay a dividend during its first year. At the end of its second year, Cherry's owners expect to pay a $2.00 dividend and plan to increase it 7% annually. If the required return is 20%, what should Cherry's stock price be? 19. Blockbuster Inc. just paid a dividend of $2 per share. Dividends are expected to grow at a rate of -50% annually over the next three years. After that, it is expected that Blockbuster will cease paying dividends forever. What is the fair market price for a share of Blockbuster if shareholders require a return of 12%? 20. The average P/E multiple in the oil industry is 16. Mobil Oil is expected to have an EPS of $4.50 in the coming year. The price of Mobil Oil stock should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts