Question: Homework question help with derivatives. Thank you 2. The current prise of Bank of America {BAG} is $1D.The ual stan dard deviation is 12%. The

Homework question help with derivatives. Thank you

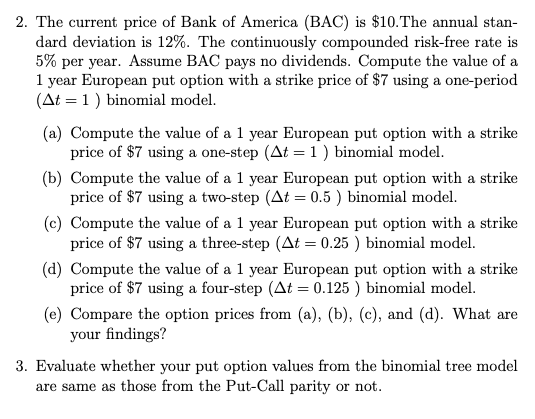

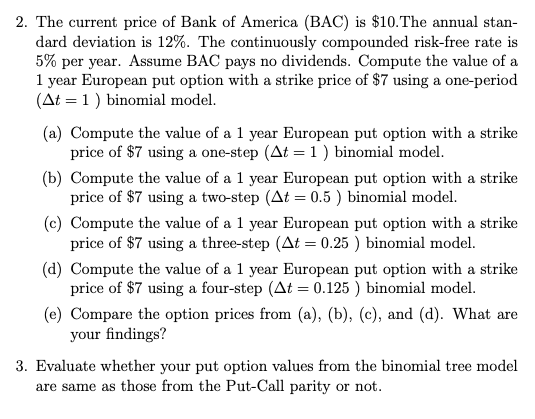

2. The current prise of Bank of America {BAG} is $1D.The ual stan dard deviation is 12%. The continuously eornpounded riskfree rate is 5% per year. Assume BAG pays no dividends. Compute the value of a 1 year European put option with a strike price of W using a oneperiod [t = 1 } binomial model. {a} |L'Jompute the value of a 1 year European put option with a strike price of W using a onestep [t = 1 J binomial model. {b} Compute the value of a 1 year European put option with a strike price of W using a twostep [it 2 [LE } binomial model. {o} |L'Jompute the value of a 1 year European put option with a strike prise of ii? using a threestep {t = 131.25 } binomial model. {d} |Compute the value of a 1 year European put option with a strike price of 13? using a fourstep [at 2 11.125 } binomial model. {e} |Compare the option prices from {a}, {b}, {a}, and {d}. 'What are your ndings? 3. Evaluate whether your put option values from the binomial tree model are same as those from the PutCall parity or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts